Stax Bill is the only solution that provides the automation, features, and expertise you need to increase your recurring revenue.

The recurring revenue gap is a problem

The recurring revenue gap is the difference between the expected revenue a company anticipates from its recurring subscriptions and the actual revenue it receives.

This gap can arise from customer churn caused by:

- Billing disputes

- Payment failures

- Difficulty in managing subscription preferences

Managing and reducing this gap is critical for subscription companies to achieve sustainable growth and maintain healthy financial performance.

3 reasons to choose Stax Bill

Stax Bill is the only solution that provides the automation, comprehensive features, and financial expertise you need to succeed.

Maximize efficiency with integrations

Subscription management isn’t a standalone process. Stax Bill works in tandem with your other key business solutions to sync data, streamline workflows, and reduce pain points along the way.

Automation

Automate the customer journey from new customer acquisition to payment collection, syncing data back to your accounting software, and manage tasks for your subscription business efficiently.

Financial Expertise

Accounting and payments expertise is crucial for accurately managing financial transactions, ensuring compliance with regulations, and improving cash flow in complex billing scenarios.

Comprehensive Features

Everything you need to succeed, without paying more.

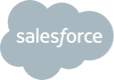

- Subscription management: Stax Bill simplifies managing subscriptions by handling routine tasks such as sign-ups and renewals. With a flexible product and pricing catalog for customizable options, ensure your business runs smoothly.

- Recurring billing: Automate complex billing processes regardless of product type or pricing model, enjoy a dramatic 80% reduction in billing time, and eliminate revenue loss due to human error.

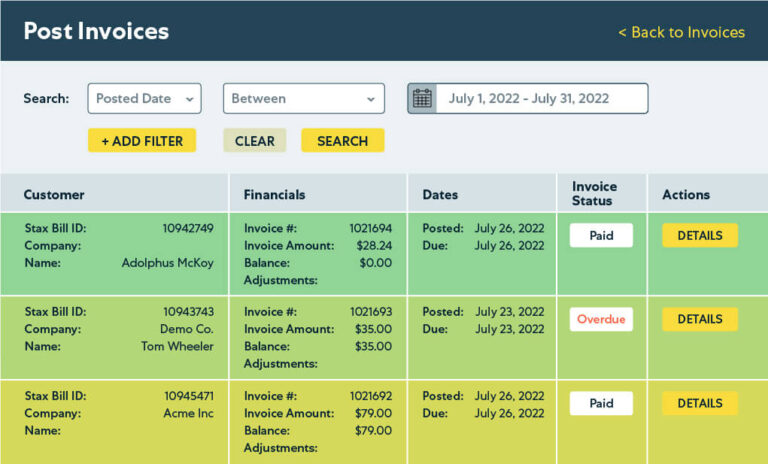

- Payment collection: Enhance your payment collection process with capabilities to automatically retry failed credit card payments, giving you control over the retry timing and attempt limits.

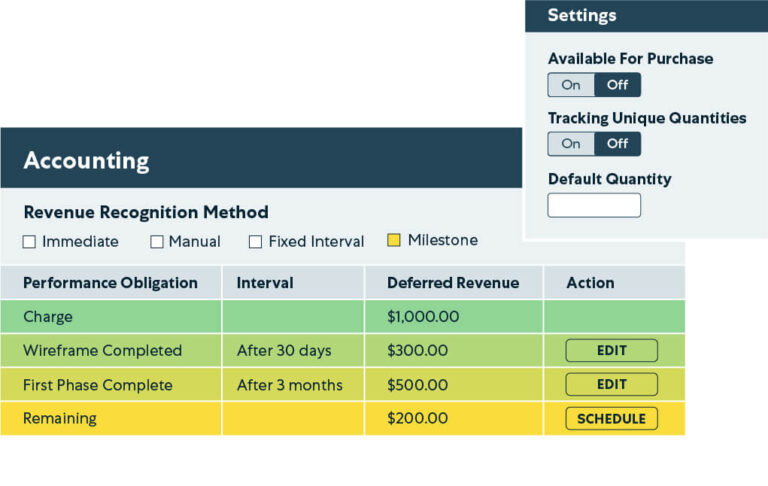

- Revenue recognition: Stax Bill provides multiple revenue recognition options, including an ASC 606-compliant milestone module, and over 50 dynamic reports for tracking cash flow and identifying revenue by product, plan, or customer, simplifying revenue clarity.

Make it your own. Scale without limitations.

Stax Bill is the flexibility you need to turn your billing pains into endless opportunities for growth.

Flat pricing. No overages.

We’ll never take a percentage of your revenue as an overage fee; we want to help your business grow, not punish it for succeeding. That’s why we provide cost certainty and the tools you need to scale your business.

Growth

For businesses with up to $85k monthly billings

No overages

No hidden fees

All features included

Enterprise

For enterprise businesses with large customer bases and diverse subscription offerings.

for a custom quote