For any SaaS (Software as a Service) or subscription-based business, growth is always the main goal. The only way to get there though is to have a clear picture of what is creating growth and contraction in your business so you can make strategic and empowered decisions that will help you scale.

This is where Monthly Recurring Revenue (MRR) comes in.

In the subscription world, MRR is the blood that keeps the heart of your business pumping. It’s one of the most important metrics you can measure.

Without this key metric, gaining crucial business insights can be like searching for a needle in a haystack.

What is MRR and why is it important?

Simply put, MRR is the total monthly revenue coming in from all recurring subscriptions. It combines both annual and monthly subscriptions as a single measurement.

While MRR is not a GAAP (Generally Accepted Accounting Principle) measurement, it is one of the most critical metrics and KPIs (Key Performance Indicators) for SaaS and other recurring billing businesses.

Unlike other reporting metrics like sales, cash, and revenue that speak to a business’s accounting team, MRR allows non-finance people like CEOs to determine if a business is growing or declining and project future revenues.

The reporting metric is a unique measurement used to track the health and growth of a subscription-based business along with customer behavior. It’s also a way to place a value on your customers or billing entities based on how much they are contributing to your business. It tells you how much these customers will contribute to your business in the long term.

With monthly subscription plans, the MRR value assigned to each customer would be the amount of money they are paying you every month. For annual plans, you would divide the price of the plan by 12 months to calculate the MRR for these particular customers.

Let’s say your business only offers one monthly and one annual subscription plan. For customers that have purchased a $75 monthly subscription, they would be assigned an MRR value of $75. If a customer has a $900 annual subscription, they would also have a $75 MRR value. If your business has a customer base of around 200, then your total MRR would be $15,000.

As you can see, for companies that offer simple pricing strategies, tracking MRR is fairly straightforward. The reason is that when you only offer one type of subscription and pricing option, all customers are contributing around the same amount and have equal value.

Take Spotify, for example. The music streaming service offers users unlimited use of its platform to all customers for just $9.99 a month. Therefore, each customer would have an MRR of $9.99.

With more complex pricing strategies or flexible billing frequency—think mobile phone and data plans, cloud storage, etc.—there are many different facets of MRR to track. Promotional offers like discounts and free trials, refunds, and cancellations, plan upgrades, downgrades, and even churn all have an effect on your MRR.

There are four types of MRR you need to be looking at:

- New Business MRR. This is the revenue earned from new customers.

- Expansion MRR. This is new revenue from existing customers when they upgrade their subscription plans.

- Contraction MRR. This refers to the revenue lost from existing customers that have downgraded their subscriptions.

- Churned MRR. This is the revenue your business loses when a customer ends the relationship.

Why MRR over other reporting metrics?

Without a reporting metric like MRR, it’s difficult to get a good idea of your business’s true health. Regular monthly revenue doesn’t account for annual subscriptions and customer upgrades or downgrades, which can create a false sense of growing or declining business health.

Here are a few scenarios to illustrate the challenges of tracking monthly revenue without the MRR metric:

Scenario #1

When Susan signed up for a Netflix account in January, she was thrilled to learn that the streaming service offered her a one-month free trial. After that 30-day period, Susan selected the $9 a month plan that allowed her to stream on just one single device.

By June, Susan had married and the couple decided to share one Netflix account. Now that two people would be using the account, Susan upgraded her plan and started paying $13 a month, so both she and her husband could stream on their own individual devices.

Fast-forward a few years later when Susan and her husband had a child. Susan upgraded her plan again so her 5-year-old son could watch children’s content on an iPad.

When users are constantly upgrading or downgrading their plans throughout the customer lifecycle, this gives the impression that your revenue is constantly going up and down even though you haven’t lost or gained any customers. The 4 types of MRR factors in subscription upgrades (Expansion MRR) and downgrades (Contraction MRR), giving you a better idea of the health of your business.

Scenario #2

A SaaS company offers a mixture of annual and monthly plans with various pricing levels and has around 300 recurring customers.

At the beginning of the month, they acquire a new customer, an accounting firm, that signs up for an annual plan priced at $2,400. The SaaS business also has 12 other new customers paying $200 a month for a monthly subscription plan. This means that for that particular month, their revenue from all those customers will be $4,800.

Since the accounting firm signed up for an annual plan and paid upfront, the following month, the SaaS company’s revenue would only come from the monthly subscribers. This means their revenue would drop to just $2,400, and appear as if revenue is decreasing, which is not the case.

MRR takes into account these annual subscriptions. By dividing the price of the annual subscription by 12 months, this business would be able to recognize $200 as MRR.

Scenario #3

Kate has been a customer of the same SaaS company for 5 years and has consistently renewed her $200 monthly subscription from year to year. As a gesture of appreciation to Kate for being a loyal customer, the company offers her a 25% discount on the next three months of her subscription.

That same month, the company offers a prospective customer a $200 discount as an incentive to sign up for an annual plan.

Revenue reporting doesn’t take into consideration these discounts and again, will appear as if revenue is constantly going up and down, potentially giving the impression of customer dissatisfaction.

A recurring billing platform enables MRR tracking to identify changes

For subscription businesses, in any given month, new customers will always be signing up and existing customers will upgrade, downgrade or potentially even take their business elsewhere. As a result, your MRR will be under constant upward and downward pressure, so it’s important to track this metric to recognize the source of these changes.

A complete recurring billing and subscription management platform like Stax Bill provides your business with access to complex, comprehensive MRR reports. These reports will enable you to not only track and measure your business’s MRR, but identify the source of any increases or decreases.

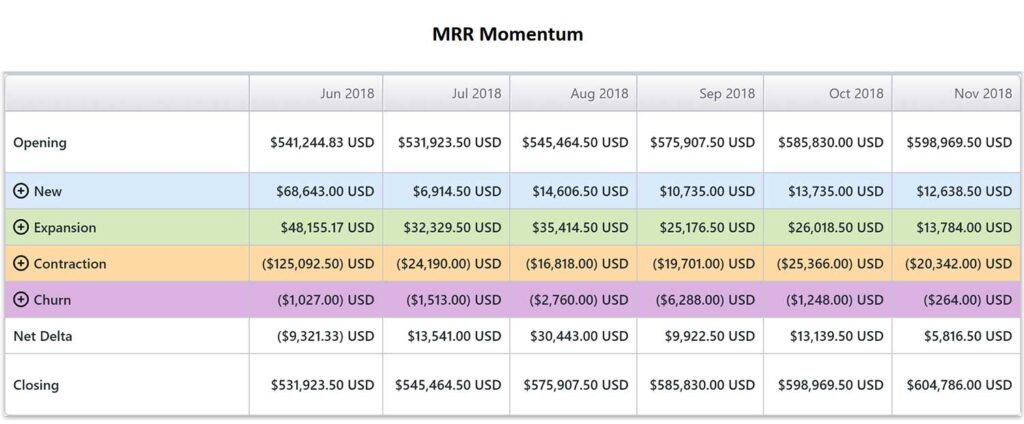

In the Stax Bill system, the MRR Momentum Report displays all of your MRR data in a table, broken down by date and by New, Expansion, Contraction and Churned MRR. It will also allow you to break down each type of MRR even further to see which customers were new, which ones upgraded or downgraded their plans and which ones churned.

This helps you gain insight into your customer base, monitor trends and make strategic decisions accordingly.

For example, a company that offers subscription plans based on how many products a customer requires might allow clients to customize their pricing by adding or removing products as they please.

If customers are constantly upgrading or downgrading, your MRR will be all over the place. A challenge with this is that it could be difficult to project future revenues when your MRR is unstable. Therefore, you may want to consider switching to a simpler pricing and subscription model.

When you do make these kinds of changes, the report will also show any MRR changes after a subscription amendment. This will enable you to see the effectiveness of the changes.

Compared to the traditional business model, a challenge of the recurring billing model is that you are not managing one-time sales, you are managing customer life cycles. This opens the door for a unique set of challenges like customer retention and churn.

Tracking your business’s MRR using a recurring billing platform can help you mitigate these challenges by identifying the source of any changes and customer dissatisfaction.

Armed with that information, you can be proactive and make tactical changes that will empower you to scale.