Let’s face it: manual billing is unscalable. Conversely, any time you automate a process, you allow your business to scale. With automation, you can move up in size without growing pains—such as hiring for execution of error-prone manual tasks.

I’ve already shared my surprise about talking to multi-million dollar companies that haven’t yet automated their billing process. This indicates a missed opportunity for growth.

Streamlining data exchange between billing, provisioning, CRM (customer relationship management), and accounting through a billing system means these processes can run in the background while your business focuses on growth.

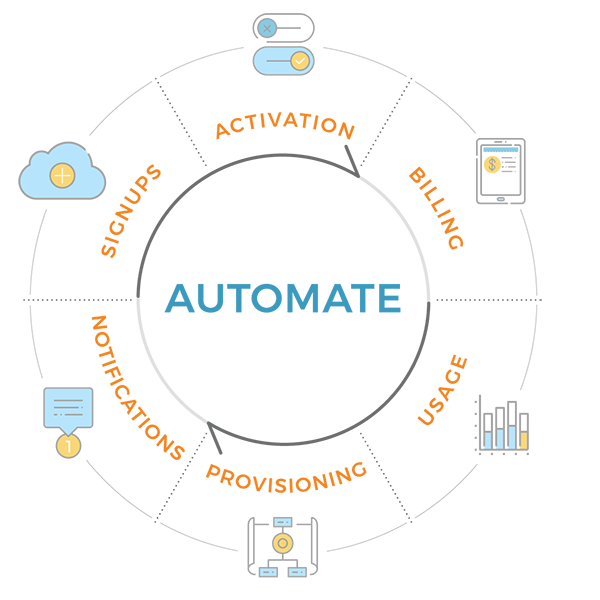

In an earlier post, we discussed how an automated billing platform resolves manual recurring billing limitations. In that article, we touched upon the billing processes an agile subscription management platform like Stax Bill automates and streamlines. Today, I’d like to delve deeper into how automation of each of these processes enables scaling at every step. Let’s take a look:

1. Signups

What does your sales process look like? This is the first question we ask businesses looking to automate their recurring billing. The answer helps us determine what workflow will be like between your business and the billing platform.

We want to explore how a robust subscription management and recurring billing system fits into your business and technology ecosystem.

When talking about automation and growth, automating signups heavily influences your time to market. A registration page that allows customers to create their own profile, sign up for their subscription of choice, and enter payment information—all without talking to a sales team member—greatly increases signup agility.

Automated signups works especially well for simple subscription offerings, such as streaming services or subscription boxes, where billing is consistent in each cycle. Taking signups off of your team’s hands and letting the process run automatically in the background gives your business the flexibility to focus on areas of business expertise versus billing issues.

When a customer clicks “Subscribe Now” on your website, they should be able to build their own subscription, enter payment details, and eventually hit “checkout.” At this point, a subscription management platform can bill appropriately and relay the customer information to your business so that you know to activate the new account.

Ideally, all of this is “white label”: customers should only see your branding. From landing pages to entering payment information and checkout, keeping your business front and center retains customer confidence in your brand.

Creating these registration pages with multiple stages can require specialized resources and generate additional expenses, but a strong subscription billing system offers an “out of the box” option. With this, your customers can sign up for their account and provide payment information in one place, ensuring billing happens smoothly. The system then communicates with yours so your team can focus on account activation, onboarding, and product delivery.

Streamlining the signup process means you can sign on more customers in less time, without extra effort on your part. A website and portal put the customer in charge of setting up their account, and an automated billing platform even collects payments for you.

All of this automation gives your business ample room to scale your business.

2. Activation

Some businesses activate a client the moment they sign up. Once the client is active, they receive their first bill immediately. Another option is to submit their first payment in order to activate their subscription. This is a simple billing process: clients are entitled to services (and owe payment) right away.

However, other businesses require a delay. A customer may sign up, but not receive services until a later time. Many businesses, understandably, won’t charge a new customer until they are utilizing services. In this scenario, manual billing becomes excessively cumbersome. Automation will help reduce the burden and increase efficiency.

Iot and Telematics device activations are a great example of this. When a customer signs up with a telematics device manufacturer or reseller, their complete profile is created—including payment information—but they shouldn’t be charged until they can actually use the service.

Only after the device is activated will the client be charged. By setting a scheduled activation date or real-time activation on their automated billing platform, businesses can create and finalize a sale for a service that isn’t immediately available.

Many SaaS (Software as a Service) businesses with onboarding processes have a similar relationship between activation and payment. For example, some have an onboarding fee for new clients. Fortunately, this is easily accommodated on a robust subscription billing platform with one-time payment processing.

Still more SaaS businesses want to offer free trials; modern subscription billing platforms allow for this as well.

In fact, comprehensive subscription software is designed to accept one-time, up-front payments, even with delayed activation dates.

This means whether there is an installation charge before recurring billing begins, or a charge of $0 for the first week of service, the accommodation is built into the system.

One-time and recurring charges should always appear on the same invoice. An agile subscription billing platform can accomplish this, and even pro-rate charges, reducing the need for billing staff to manually do so.

Streamlining the activation process in these various scenarios means your business can activate accounts at a higher, faster rate than would be manageable manually.

3. Billing

One of the important ways subscription management systems help businesses scale is by keeping them compliant with accounting principles like GAAP (Generally Accepted Accounting Principles). Accuracy in revenue recognition is important for growing businesses, and many with less agile billing software are simply not meeting the GAAP standards.

Subscription billing platforms like Stax Bill automatically track recognized revenue based on where customers are in their subscription cycle. This ensures that recognized revenue compliance requirements are met.

Reducing overheads by automating invoicing and revenue tracking is efficient; so is automating the collections process. Instead of waiting for people to pay their invoice, a credit card can be held on file and charged automatically. Collections happen right away.

If a payment fails, automatic retries are scheduled to keep the customer’s payments current. This kind of dunning management leads to revenue recovery and reduces revenue leakage by 2% – 4%.

Using modern subscription management software not only reduces billing inaccuracies and manual labor, but puts money back into your bottom line. These platforms also reduce revenue leakage via failed payments, overdue invoices, and human error from hundreds of manually handled invoices.

Many businesses use homegrown billing solutions, and eventually have to have a “buy vs. build” conversation. After all, if they have their own development team, why pay for a billing solution they could build themselves?

One good reason to buy is specialized expertise. No development team is going to be able to build a robust billing platform in a short amount of time. Maintaining home grown platforms results in significant overheads too. With billing and invoicing key to revenue and scaling, it’s not worth delaying automation.

An agile recurring billing platform offers ROI through reporting, templates, catalog flexibility, and more that would be difficult to build even in a year.

Most homegrown methods are messy: revenue recognition is off, there’s little or no transparency to clients, and reporting can’t capture how much revenue is coming in per product or plan.

Lack of transparency prevents these businesses from scaling. An agile monetization platform enables growth and is also PCI compliant, while many homegrown solutions are not. Credit card and personal customer details are safe, encrypted, and much more secure than credit card collection information via phone or email.

Manual invoicing for many businesses means accepting paper payments like cash and check. Moving towards automating invoicing can put a bank account or credit card on file and reduce the check collection process. A robust billing platform can accept checks, as well as ACH, PayPal, bank wire, cash, and of course, credit cards—there’s no risk of losing paper-paying customers.

4. Usage

Some businesses, such as cell phone service providers, give an allowance of data. You may get 10G of data per month for $50, but if you cross over that 10G threshold, there may be a charge per gig until the new monthly cycle begins.

This is called “usage charge”. You track usage through provisioning: how much data/time/reports etc. have customers used? By automating the push of that data to a subscription management platform, and letting the software automate billing from that point, your business unlocks huge scaling potential.

Automation removes the headache of a team member looking at individual accounts for overages of usage, and manually adding those overage charges to invoices. Similar to one-time charges, an agile subscription billing platform automatically adds these to the same invoice as recurring charges, so it’s all in one easy place for the customer to see and pay.

Using push technology to communicate overages to a billing platform that can charge accordingly saves loads of time and money. A process that is normally a manual nightmare becomes simple.

Advanced subscription management allows you the flexibility to deploy various pricing strategies that includes one-time payments, usage-based pricing, hybrid pricing, and multiple other variations and combinations.

5. Provisioning

An agile subscription billing platform can ensure that customers receive the appropriate access to what they have signed up for. The platform integrates with provisioning and entitlements, and relays the current payment-based access to be allocated to the customer.

On the other hand, it is bad business to provide a product the customer isn’t paying for. That’s simply not viable practice for scaling a business.

A comprehensive subscription billing platform can see if a payment is overdue or has failed. The platform will have a credit card on file, and know whether it has expired. If an invoice is overdue, payment has failed, or a customer doesn’t have a valid card—in any situation where they owe money—the platform can put their account in “poor standing”, signaling your business to pause or cancel service.

Once payment is retried and successful, their account will return to “good standing”, signaling your business to resume service. This all happens in real-time, maximizing customer experience and increasing retention so you can scale.

This ensures that you aren’t providing a service that customers aren’t paying for, plugging a sneaky source of revenue leakage.

As an example, On The Map Marketing could previously send out about 100 invoices a month, they now send 600 through Stax Bill. On The Map considers the platform’s functions tremendously beneficial in revenue recovery, with an average of $600,000 recovered each year. Read the detailed case study

People forget to cancel subscriptions they’re not using all the time: Have you always used your gym membership to its full potential? With subscriptions they do use all the time, however, stopping service ensures that they’ll take a moment to update their payment information and reactivate.

By automating card information collection, payments, card retries, and dunning, you ensure that your business is collecting revenue for services rendered.

Often, businesses don’t know which customers are in good standing, and which are in poor standing. They know they’re giving away free products, but have no way of effectively tracking how it is happening. As a business scales, communication with hundreds of customers about recurring payments becomes unmanageable; when that happens, it’s time to automate.

6. Notifications

A robust subscription management platform will communicate with clients once they’ve been activated or updated a subscription, but most importantly, communication centers around invoices and payments.

Good client relationships are established when:

- customers know that they owe money

- there is transparency regarding what they’re paying for

- they can see their transaction history

With these pieces in place, customers will want to stick around.

Upcoming billing notifications are also important, so clients know to expect a bill. The same goes for upcoming credit card expiration dates. Automating the process through which customers update their payment information is yet another opportunity to save time and resources. Once updated, communicating the change to both the customer and your business keeps a subscription running smoothly, and customer satisfaction high.

After a failed payment, it’s important to let customers know that a new payment attempt has worked. In a situation where a refund is necessary, seamless crediting to the customer account, and notification that action has been taken, helps maintain strong relationships. This all can be automated with a recurring billing platform.

Again, all of this should be provided white-label, with your business’ branding appearing on invoices, landing pages, emails, etc., without any customer-facing evidence of the billing platform. Unfortunately, unlike Stax Bill, some other recurring billing platforms include a footnote on invoices and pages along the lines of “This invoice generated by ______.” This doesn’t look very professional to your customer base.

Effectively branded notifications, emails, and interface, along with timely and professional customer communications boosts satisfaction and retention as you scale.

There you have it: all six stages of the subscription billing process, and how they relate to scaling your business. Think it may be time to introduce a robust billing solution to your business? Reach out to us here at Stax Bill to see if we’re right for you.