Whether it’s the moment after a sale is made or the day the first invoice is sent out, growing and maintaining positive customer relationships throughout the entire customer lifecycle is the key to success for any subscription-based business.

However, many businesses tend to focus all their energy on that initial sale and don’t pay enough attention to the complete customer lifecycle. This is especially common with companies that focus on leveraging only the out-of-the-box functionality of a customer relationship management (CRM) platform like Salesforce.

Salesforce is now considered the world’s leading CRM solution and is a powerful tool for your sales team as it helps them sign-up new customers, allows them to track leads, manage sales data, customers and accounts, and can even improve customer retention by as much as 27%.

Proficiency in Salesforce is also becoming increasingly valuable as the demand for Salesforce trained professionals is growing rapidly.

However, Salesforce is not designed for the recurring billing world which often creates problems for subscription-based businesses on the billing side after new customers are created.

Due to minimal recurring billing capabilities of Salesforce, when using Salesforce alone to manage sales in your subscription business, new customer sign-ups can mean tedious manual processes for your billing team. As the business brings in more customers, these processes need to be repeated on a recurring basis.

Once you begin to scale, manual processes become extremely difficult for your billing clerks to manage, leading to countless errors and resulting in poor customer experiences. For example, customers may need to wait for activations, upgrades, and downgrades. The result can be a higher churn rate.

One way to bridge the gap between your sales and billing systems is to integrate your Salesforce account with an automated recurring billing platform.

Advanced recurring billing platforms are designed to support customer interactions like ordering, account upgrades and downgrades, payments, receiving invoices, disputes and managing payment information. By integrating such platforms with your CRM, you can reap the benefits of both technologies.

When integrating the two systems, you can take one of two popular approaches, each with their own set of advantages.

1. Pushing data from Salesforce into a recurring billing platform

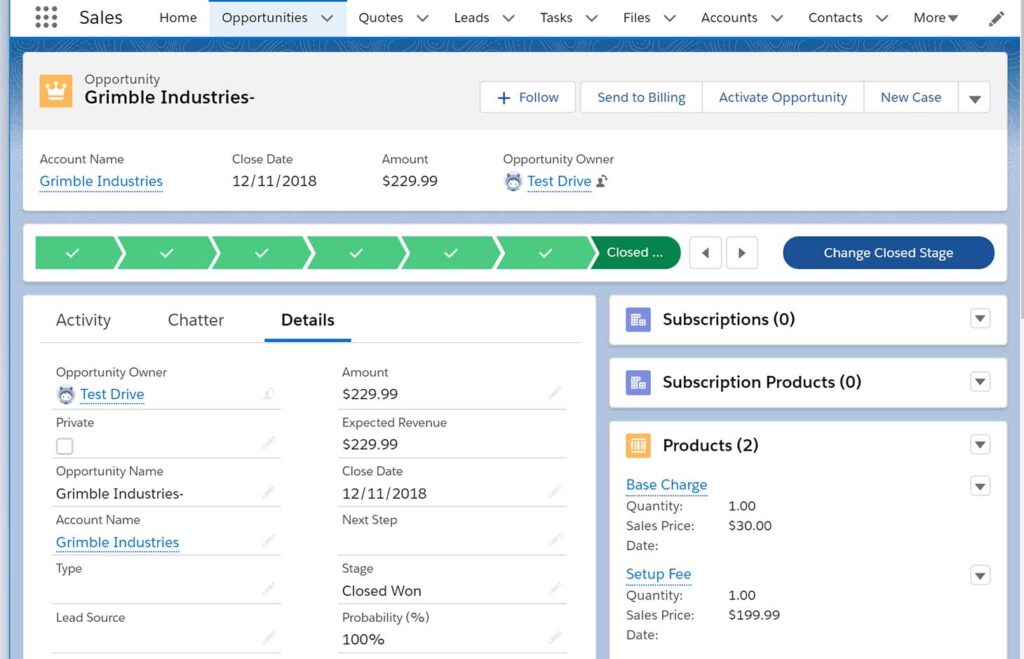

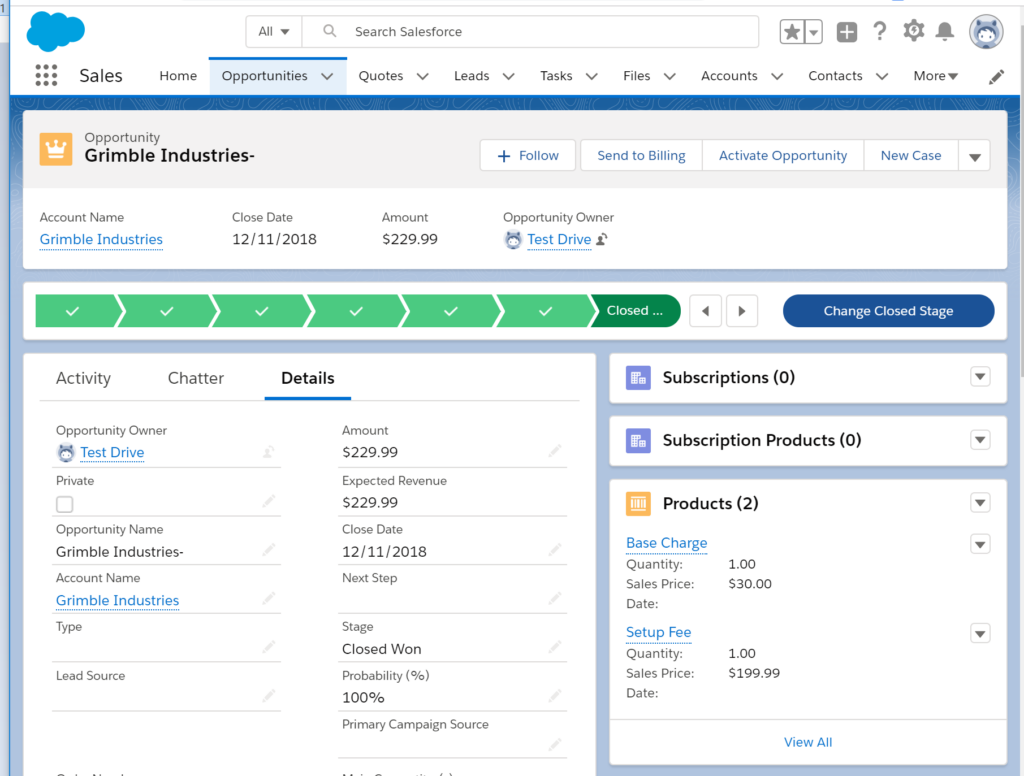

Modern automated billing platforms, including Stax Bill, have plug-ins that will empower Salesforce to act as a doorway that allows the sales team to easily create customers to be billed on a recurring basis in Salesforce.

These plugin enabled workflows will also seamlessly submit their closed-won opportunities over to the billing department without having to manually re-enter all the customer data. This option provides a streamlined, automated catalog sync to maintain all your service offerings in one place and makes important client information like subscription status and invoice details available to the sales team in Salesforce.

The main advantage of this workflow is that you can leverage all the functions and tools that Salesforce already offers, such as quotes, contracts and orders while creating accounts, managing subscriptions, and viewing customer information. All without leaving Salesforce.

It’s about making the whole quote to cash process as easy as possible, with minimal clicks. Right from the customer commitment point, to automated payment capture, to automated deposits on a recurring basis.

2. Pushing data from your billing platform into Salesforce

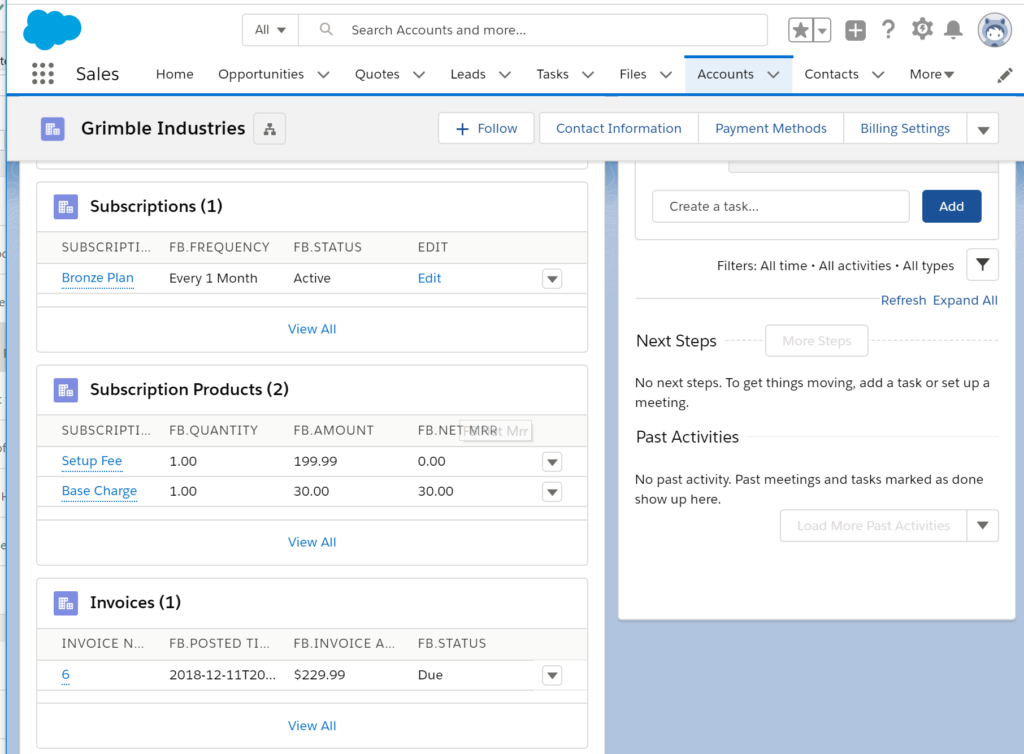

Instead of creating new customers in Salesforce and pushing their data into your billing system, another option is to do the opposite. You can set up your recurring billing platform to automatically push new customers over to Salesforce.

In this workflow, new customers created in your automated billing platform are automatically sent to Salesforce with account fields and subscription data. Information for existing customers like status, balance, subscription cancellations, and subscription settings like payment methods will also be pushed into Salesforce.

Some of the advantages of this particular workflow include the following.

- Visibility.

Integrating your recurring billing system with Salesforce means all of your data is readily available in Salesforce, allowing you to have everything set up in one place. This allows you to gain visibility into an important part of customer management and lets you see who your real paying customers are along with their subscriptions and accounting information. - Management.

Salesforce does not provide a way to add customer payment methods in a PCI (Payment Card Industry) compliant manner, but with integration, you have the ability to manage your customers, subscriptions, invoices and pricing along with customers’ billing settings like payment methods from within Salesforce. Advanced enterprise recurring billing platforms like Stax Bill are PCI 1 compliant. - Reporting.

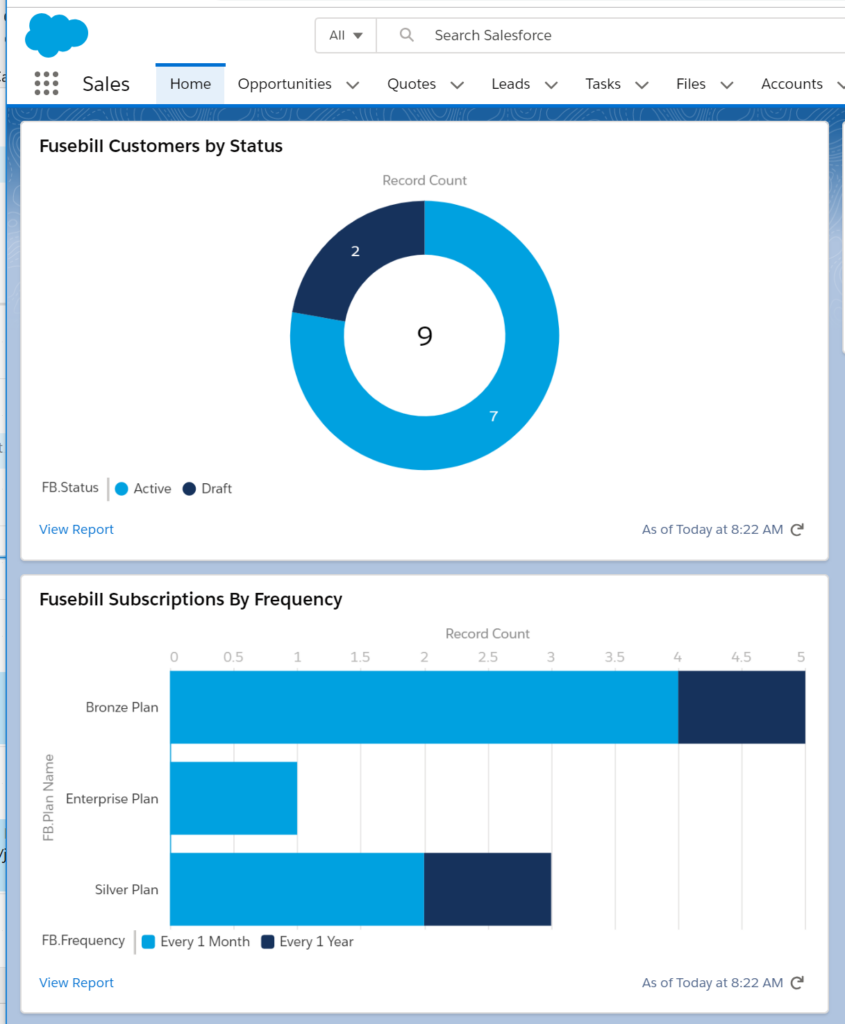

All your data being pushed from your billing platform can be used for reporting in Salesforce. Certain data fields that would have only been available in your billing platform can also be utilized in Salesforce, allowing you to build reports and derive important insights. You can also leverage your reporting to include your billing processing.

This workflow also enhances the ability of businesses to ‘farm’ additional revenues from existing Salesforce accounts. For example, your client success team could see the historical financial information to discover potential up-sell opportunities.

Integrate to create a business advantage

The demand for Salesforce is growing rapidly. It is estimated that by 2022, the CRM platform will have generated $859 billion in revenue for its customers, leading to the creation of 3.3 million jobs.

Similarly, the subscription business model is also increasingly popular and has grown by 100 percent every year in the past five years. Businesses that can achieve a successful integration of people, technology, and processes to tap into these huge opportunities are poised for market leadership in the coming years.

Integrating a powerful CRM like Salesforce with a leading subscription management and recurring billing platform can provide your business with a competitive advantage.

There are also other benefits that accompany the integration of the CRM with a powerful recurring billing platform, such as:

- Reduced revenue leakage.

Revenue leakage is when your business unintentionally loses money due to charges not being issued, credit cards not being retried, or other errors resulting from a manual billing process. Automated billing streamlines your billing process and eliminates human errors that lead to lost revenue. - Reduced churn rates.

Subscription-based businesses are susceptible to churn for many reasons including billing cycles.

For example, churn often occurs more quickly towards the beginning of the subscription billing cycle when businesses tend to lose a large number of customers during the first month of their subscription—common with businesses that offer a free trial. However, churn can still occur when credit cards are charged on a monthly or annual basis. A recurring billing platform automatically issues notifications of upcoming credit card or subscription expirations and late payments. - Revenue recognition.

With the subscription business model, revenue must be recognized daily even though payment may be collected for future services. This can be difficult to do manually without creating errors. Furthermore, revenue recognition must be calculated according to the new GAAP (generally accepted accounting principle) standard ASC 606. With a recurring billing platform, revenue recognition is handled automatically.

Regardless of which workflow you decide works best, ensuring your CRM and billing systems are in sync is crucial to the success of your business, can help maintain positive customer relationships throughout the entire lifecycle, and secure a marketplace advantage.

Integrating Salesforce with an advanced recurring billing platform allows businesses to efficiently manage billing, invoicing and payments on an automatic, recurring basis while still benefiting from the features that the world leading Salesforce CRM has to offer.

The Stax Bill and Salesforce integration. Get started on your configure, price, quote journey with Stax Bill and Salesforce.

FAQs about Integrating Salesforce CRM

Q: What is the benefit of integrating Salesforce CRM with a recurring billing platform?

Integrating Salesforce CRM with a recurring billing platform provides multiple benefits, including streamlined operations and improved customer experience. It automates billing processes, reduces manual errors, and enhances data visibility across sales and billing departments. This integration allows businesses to manage subscriptions, invoices, and customer payment information efficiently, leading to reduced churn rates and minimized revenue leakage.

Q: How does Salesforce integration improve customer experience in subscription-based businesses?

Salesforce integration improves customer experience by automating the billing cycle, ensuring timely invoicing, and providing seamless upgrades or downgrades of services. It eliminates manual errors and delays, which can frustrate customers. The integration also ensures that the sales team has access to up-to-date customer information, allowing for personalized interactions and better service.

Q: Can Salesforce alone handle recurring billing for subscription businesses?

Although Salesforce is a powerful CRM tool, it is not designed specifically for recurring billing. Subscription-based businesses may face challenges with manual and repetitive billing tasks when using Salesforce alone. Integrating it with a specialized recurring billing platform addresses these limitations by automating billing processes and enhancing overall operational efficiency.

Q: What are some common approaches to integrating Salesforce with a billing platform?

Two popular approaches exist for integrating Salesforce with a billing platform: pushing data from Salesforce to the billing system or vice versa. The first approach allows Salesforce to act as a gateway for billing data, while the second sends customer and subscription information from the billing platform to Salesforce. Each method has its own advantages, such as data visibility and streamlined workflows.

Q: How does integration help with revenue recognition and compliance?

Integration with a recurring billing platform aids in accurate revenue recognition by automating calculations according to the GAAP ASC 606 standards. This reduces the risk of errors associated with manual calculations and ensures compliance with accounting principles, which is particularly important for subscription-based revenue models.

Q: What role does automation play in reducing churn rates?

Automation plays a crucial role in reducing churn rates by ensuring timely billing and notifications for subscription renewals or expirations. Automated systems can alert customers to upcoming charges or expired payment methods, allowing them to update their information proactively, thus preventing involuntary churn.

Q: How does the integration of Salesforce and billing platforms enhance reporting?

The integration enhances reporting capabilities by consolidating data from both systems into Salesforce. This unified data allows businesses to generate comprehensive reports that include sales performance, billing efficiency, and customer account status, enabling informed decision-making and strategic planning.

Q: What impact does Salesforce integration have on business scalability?

Salesforce integration supports business scalability by automating repetitive billing tasks, thus freeing up resources and allowing staff to focus on strategic growth initiatives. It also provides a scalable infrastructure that can handle increased transaction volumes without compromising efficiency, which is vital for growing subscription-based businesses.