Dunning management is the process set forth to recover lost revenue from failed payments. The Merriam-Webster dictionary describes the verb ‘dun’ as “to make persistent demands upon for payment,” or “plague, pester.”

While traditional businesses may have taken the meaning of dun down a more literal path, subscription-based businesses have to adopt a more customer-centric approach. They have to institute a congenial, yet strategic method to revenue recovery.

Dunning management is an extraordinarily powerful tool for a business that does recurring billing. However, just like any tool, it’s essential to know how to optimize dunning tactics to produce the best results.

There are three major components of dunning management:

- Retrying failed payments

- Communication with the customer

- Empowering the customer to make payment updates themselves.

Digging into each facet of dunning management will help improve relationships with your customers, extend customer lifecycles, and reduce churn.

1. Optimize Dunning Management with Automatic Payment Retries

First, dunning management is the act of retrying failed credit card payments in the hopes of processing a successful collection.

The success rate of retries can vary, but in all likelihood, you will see a significant percentage—sometimes as much as 75%—of revenue recovered simply by retrying a credit card a few days after it initially failed.

Credit card payments can fail for a variety of reasons. One common cause is insufficient funds, but that is only one of several reasons a card might be declined. Insufficient funds and suspected fraud do not account for all card payment failures.

Other reasons can include:

- The card has expired

- The card was swiped incorrectly

- The card numbers were keyed in incorrectly

- The billing address doesn’t match what is on file with the bank

- The card was reported lost or stolen

- The bank doesn’t allow that particular type of transaction

- The bank’s system is down and isn’t responding to the card being processed

- A purchase exceeds the withdrawal limit

- A new credit card was not correctly activated

- The bank suspects a fraudulent purchase

Many subscription management and recurring billing platforms can automatically retry failed payments at set intervals. It’s important to give a customer a few days before retry attempts, to allow for any issues with the card to be cleared up. If they are using a debit card tied to a bank account, it may be as simple as retrying the card a week or two later, after their next paycheck.

Often, automatic retries are so successful that there is no lapse in service and the end-user doesn’t even realize what was going on behind the scenes. All they know is their subscription is still valid.

When we work with subscription-billing businesses, it’s impressive to see just how much revenue they can recover by simply retrying a credit card.

So why would a business not automatically retry a credit card?

A. Businesses May Not Know They Are Allowed to Retry a Credit Card.

There may be a lack of awareness on the part of a business. Consider what happens with a purchase at a traditional storefront—if a credit card fails; the cashier simply asks the customer to swipe their card again. There is nothing preventing a business, traditional or subscription, from systematically retrying a card to collect payment.

Of course, if customers aren’t able to provide valid payment for goods in the traditional, one-time sales model, they aren’t able to just take their purchase. They will have to return at a later time to complete the transaction. Similarly, if dunning tactics fail, a recurring billing business customer will have to provide alternate payment to complete their purchase and start or continue their subscription.

B. Businesses May be Concerned About Incurring Costs When Retrying Credit Cards.

Sometimes, a business may assume that they are going to pay a fee when retrying a credit card. This is not usually the case. The fees gateway providers collect are a percentage of successful payments and do not charge each time a payment is tried.

C. Businesses Might Not Think it’s Worth it to Retry a Card.

Businesses may know that they can indeed retry cards, but they don’t think that it would be worth it to go through the process of setting up a credit card retry schedule. Thinking it’s going to be more trouble than it’s worth, they don’t take the time to investigate this option.

However, specialized recurring billing platforms like Stax Bill can automatically set up retry schedules for every failed card. Once the schedule is created, a business can simply let the system automatically retry these payments.

D. Businesses Want to Retry Cards, but They Need to Understand The Retry Schedule Better.

Most recurring billing platforms have a default retry attempt. At Stax Bill, our default retry attempts are on days 1, 3, and 5 in a billing cycle. However, these retry days are customizable depending on business preferences.

Recurring billing is about managing customer lifecycles. You need to automate the retry behavior or risk losing the customer. Keep in mind that your product is valuable to your customer. They will appreciate the automation of retries because they don’t want to lose services due to temporary issues with their payment method.

2. Proactively Communicate With The Customer About Failing Payments.

Last year, Adobe released a report summarizing digital trends in 2018. Of the more than 12,000 marketers that were surveyed regarding these trends, 45% reported that experience management, or positive experiences with customers, was one of their top three initiatives.

Communication is essential in creating a positive customer, or user experience (also referred to as UX). As subscription-based businesses continue to flourish and gain traction in the sales ecosystem, customers have come to expect a solid line of communication between themselves and a business. They also expect communication to unfold in a positive manner.

Here are a few tips to keep in mind when creating an email alerting a customer to a payment method problem:

- Be nice. The road to customer churn is paved with ‘turned off’ customers, which can easily happen if your message is perceived as offensive. If a message is worded too aggressively, you risk losing them. A congenial ‘Hi, Fred!’ sets the stage for a friendly exchange.

- Keep it simple. Tell customers the problem with a clear call to action, including a link to update information.

- Tell customers what is due. Customers are generally managing multiple subscriptions and might not remember what their subscription rate is.

- Remind customers of payment due dates. Providing the due date generates a sense of urgency to update payment methods.

- Provide contact information. If a customer has a question, it’s essential to provide a link that they can click for more information.

Remember the old adage: You catch more flies with honey than you do with vinegar.

While it’s critical to communicate when customers’ payments fail, overlaying the importance of communication is the need to do so nicely.

Subscription management and recurring billing software can automate the emails sent to customers, as well as the schedule for when each email is sent out. Even though the automation process simplifies the workload for subscription-based businesses, it’s important to space out your email schedule and not send too many messages, too often.

If a customer receives too many emails from you, you run the risk of desensitizing them to your communications. Desensitize them enough, and they might just start hitting the delete button every time an invoice or email about a failed payment is sent.

The final state in non-payment is customer churn and a canceled subscription. Keeping in mind that preventable customer churn is a growth impediment, it’s in the best interest of a business to maintain a positive relationship with customers.

3. Empower Customers to Fix or Update Their Payment Methods.

It’s not just about a friendly voice on the customer service phone line; it’s also about the business reaching out to customers during the billing cycle. For example, if a customer’s credit card is set to expire before the next billing cycle, a business can reach out prior to that cycle to alert them of the upcoming change.

This empowers customers to update their payment method before the credit card expires. A subscription management platform with an SSP, or self-service portal, provides the means for customers to make changes in their own time, at their convenience.

End-users often struggle to take action. To mitigate this, it is critical to empower those customers as much as possible.

What Are The Potential Impacts of a Retry Schedule?

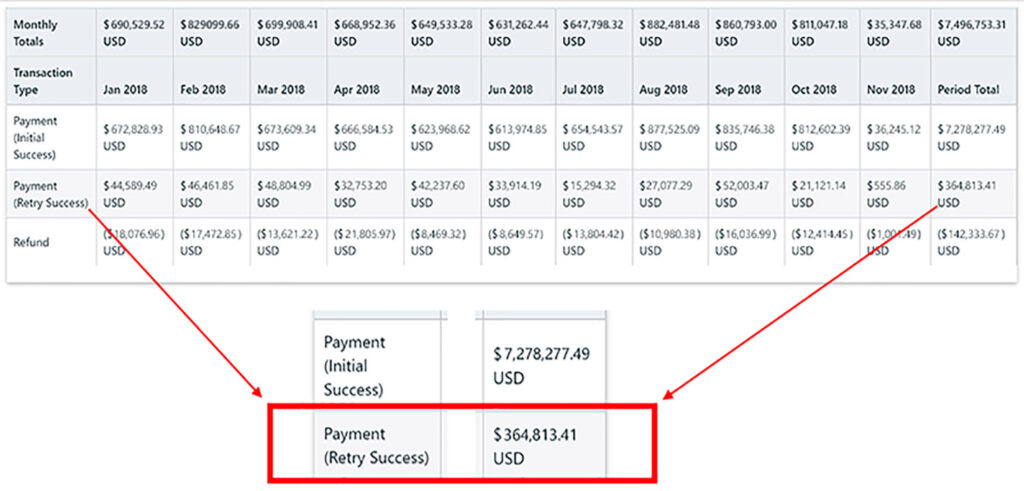

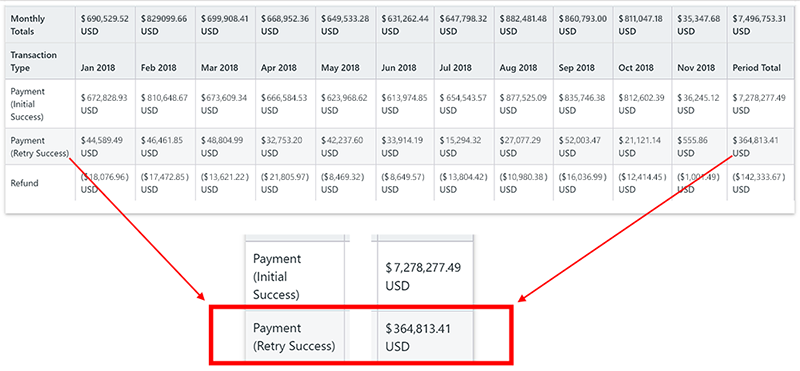

Many recurring billing businesses can recover as much as 5% of their recurring revenue by implementing a dunning management process. At Stax Bill, we work with one subscription-based business that recovered $364,813.41 out of a total of $7,278,277.49 in payments in less than a year by implementing automatic retries through our platform.

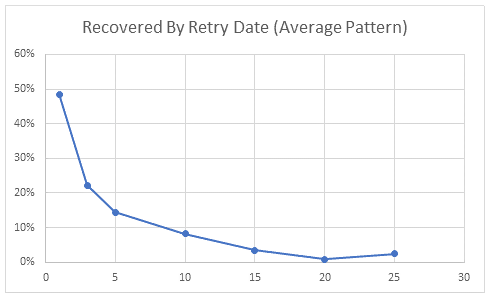

As mentioned before, Stax Bill’s default retry sequence is on days 1, 3, and 5. On average, businesses can expect to recover 1.5% of failed payments by retrying cards on those days alone.

We have found that businesses who extend their retry attempts beyond the fifth day can push their retry recovery rate even higher, anywhere from 2% to 6% on average. For example, retrying a failed payment on day 14 and day 28 gives customers the opportunity to rectify collection issues.

What is The Best Retry Schedule for Your Subscription-based Business?

Each business is different; it is important to take variations into account when determining your best retry schedule. Imagine a customer credit card that has maxed out and was declined when the customer was en-route to the airport on a Friday. They may not have had the time to resolve the issue until Monday. In this scenario, a retry of 1 day would not result in successful payment recovery.

These are four important areas to factor in when scheduling payment method retries:

- Your average payment amount

- Whether your customers are businesses or individual consumers

- Whether your subscribers pay monthly or annually

- Whether you recharge your customers on specific days of the month

To optimize your recovery rate, it is important to analyze and experiment with the retry schedule in order to isolate the best pattern for each situation.

For example, here are the average successful recovery rates with Stax Bill’s platform.

Notice that while retry recovery rates do drop off on average, churn mitigation is still possible beyond the standard 5-day retry schedule.

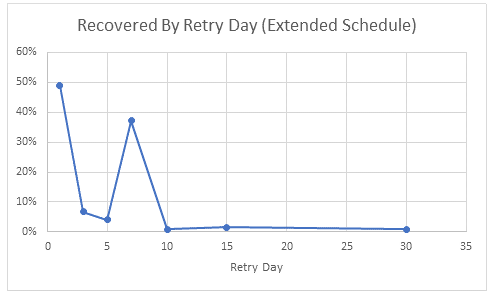

Here is an example of one business that experimented with their dunning management retry schedule.

There is a distinctive bump in payment recovery on day 7, as well as a small recovery as far as 30 days out from the initial payment attempt.

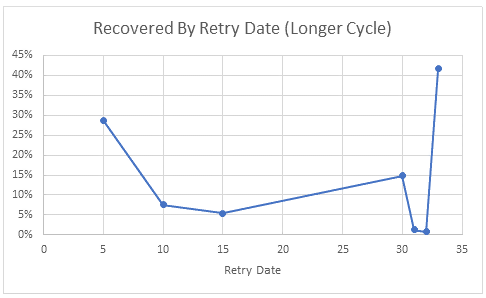

Below are the results when one business experimented with a longer retry schedule.

The spike in recovery on day 33 underscores the importance of trying different recovery schedules. The above example might work well for a business recharging all of their subscribers on the first day of the month.

You may wonder: why not just retry failed payments every day until they’re successful?

There is a fine line between successful revenue recovery with retries, and implementing the practice too aggressively. If you retry payments too often, it can lead to your payment gateway flagging your account with excessive fails. This can impact the rate you get from your payment provider.

In recurring billing situations, losing the customer is more than just losing that current payment. It’s losing that customer and all the future payments they would have made throughout the customer lifecycle. Consequently, if you are invoicing an end-user for a $90/month payment that you can’t collect, your business is not just losing out on $90. You are losing out on $90 per month for the foreseeable future.

That’s just one customer. Scale that by tens or hundreds of customers without a dunning management strategy in place, and you could be losing out on a staggering amount of predictable, recurring revenue every month for the length of an average customer lifecycle.

Now that really adds up.