As a subscription business leader, you have approximately one million things on your mind at all times. Whether or not your customers are going to pay for your product shouldn’t be one of them.

Unfortunately, it’s pretty common for SaaS and other subscription-based businesses to end up with a sizeable number of unpaid invoices aging away in their accounts receivable. It can be tough for your billing team to stay on top of it all—especially if your dunning management and collections processes are handled manually.

The result?

Those unpaid invoices become increasingly difficult to collect on the older they get. Your hard-earned revenue starts to slip through the cracks and your cash flow suffers.

In the modern business world, automation is touted as being almost a superpower. It seems there’s nothing it can’t do—it makes processes efficient, it optimizes output while it frees up time for your team to focus on important tasks, and it all but eliminates human error.

But can automation help with those aging accounts receivables so you can get paid? After all, you can’t just automatically collect money from customers that can’t or won’t pay up.

As it turns out, the answer is ‘yes’.

Maximizing Collections Assurance With Automated Billing Software

Recurring billing software providers like Stax Bill are in the business of simplifying the entire recurring billing process for their customers. And of course, an important part of that is assisting your accounts receivable team in collecting money from customers that have outstanding balances.

Given that it’s a big, recurring task, you need your automated billing system to provide a whole suite of tools that help your finance team maximize its ability to collect funds and stay ahead of aging accounts receivables.

What Your Subscription Business Should Look for in Your Automated Billing Software

There are several key features and functionalities you should always look for in your automated recurring billing software.

- Credit card auto-updating: Losing a customer to involuntary churn hurts, and unfortunately, expired credit cards is one of the most common causes. However, each of the major credit card brands work with merchants to keep on-file card information up to date. Many automated billing software options have this as part of their standard feature set, maintaining your business’s ability to automate payment processing. It also ensures your customers’ service is never interrupted and your business’s recurring revenue remains steady.

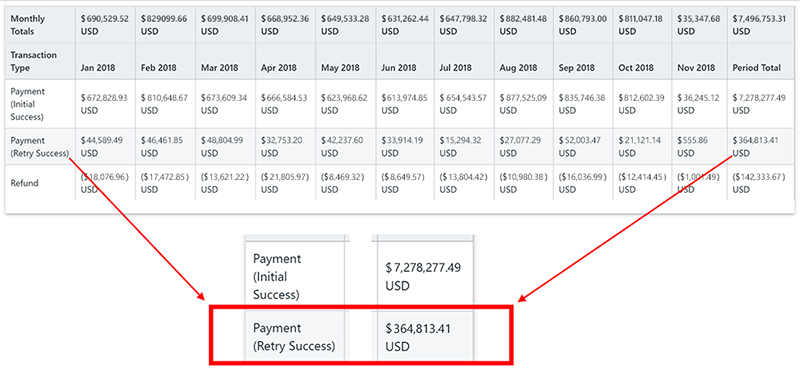

- Payment method retries: Up to 75% of revenue lost from failed payments can be recovered simply by retrying the payment method. Automated billing software will streamline this so well that the customer often never even realizes there was an issue to begin with, and your billing team doesn’t have to get involved (see the Stax Bill customer example above).

- Dunning management communications: Sometimes, you don’t have an active payment method on file or the automatic retry still fails—that means you need to contact the customer. With the right automated billing system, payment-related communications can be taken care of and your customer will be notified with no action required from your billing team. This can save time for everyone.

These payment reminders should also make it easy for the customer to take action with a link to your customer self-service portal so they can update their payment method on file, make a one-time payment, review their invoicing, etc. - Reporting capabilities: It’s important for your business to have an accurate financial report and line of sight into the status of its receivables. Automated billing software provides you with access to this info in whatever level of detail you need—whether it’s a high-level overview or a detailed deep-dive.

When some invoices inevitably do end up overdue despite the automated billing retries and customer billing communications, the insight that comes from those reports is the next superpower.

How Robust Accounts Receivable Aging Reports Benefit Your Business

Imagine your business signs a million-dollar deal. That’s great, right?

Of course it is, but there’s a difference between simply signing that deal and actually collecting the money from the customer.

For a SaaS business, unfortunately, there’s always the risk a customer may just never pay. And because of this, many CEOs and CFOs worry the revenue they’re reporting to stakeholders goes uncollected.

For you, as a subscription business leader, it’s hard to have your pulse on everything when you work with a large customer base. You need to know whether your billing clerks are doing everything in their power to maximize collections assurance, not to mention ensure proper revenue recognition.

And the reality for most business leaders—unless they have a modern automated billing system with powerful accounts receivable reporting abilities—is that they just don’t have that visibility.

Get Comprehensive Reporting On Your Aging Accounts Receivables

Let’s take a look at how this reporting works within Stax Bill’s automated subscription billing platform.

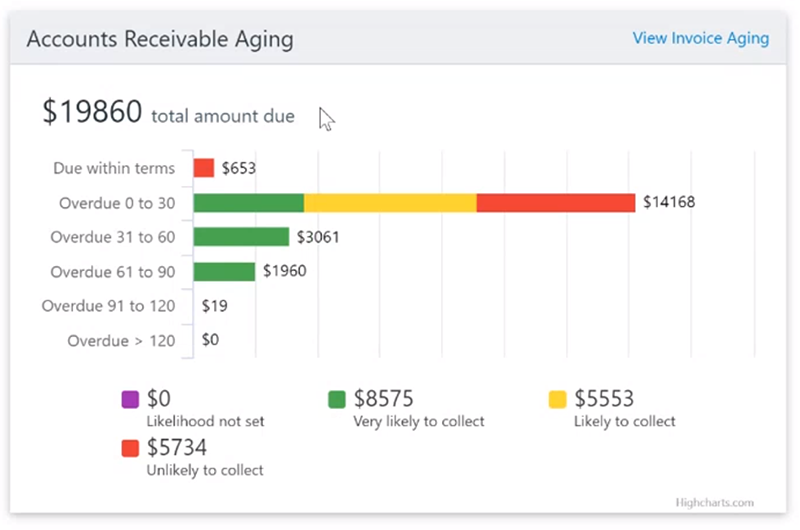

For each customer that has unpaid invoices, the billing clerk can go in and set the likelihood of their balance being paid.

- Green: the customer is very likely to pay. They’ve probably been in touch and let your business know that a check is in the mail.

- Yellow: the customer is likely to pay. Maybe your billing team has reached out, but not received a response.

- Red: the customer is unlikely to pay. This would mean your billing team has heard from the customer, and the customer said they’re unhappy with your service, they don’t remember signing up, etc. Bottom line—they don’t want to pay. It could also mean that months have gone by with zero response form the customer, so payment collection is unlikely.

A high-level glance at your aging invoice situation is nice, but to alleviate any worries about nonpayment, you need more visibility. You need to be able to take action and track it to completion.

Dig Deeper Into Your Aging Invoices With The Right Automated Billing System

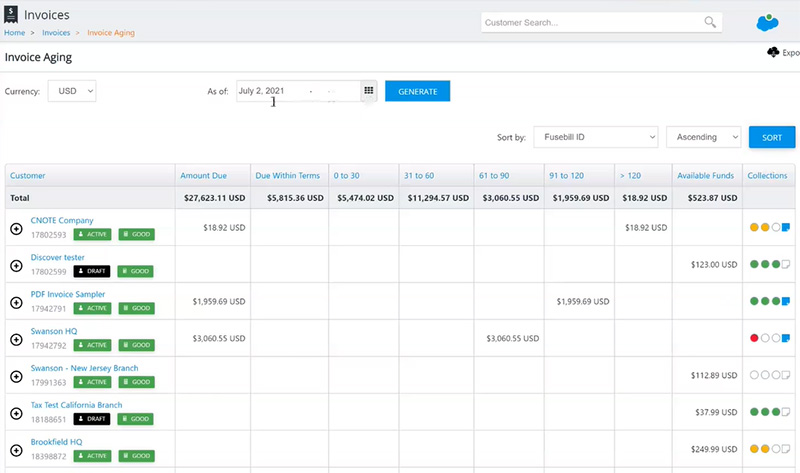

Say your widget looks like the sample image above and you want more insight into those invoices in the 0-30 days overdue range that have been marked as ‘unlikely to collect’. Simply clicking on that red section of the bar brings you to another view that enables you to drill down into greater detail.

You’ll be able to see exactly:

- which of your customers have late payments and unpaid invoices

- how many invoices each customer has outstanding, and

- what the total dollar amount of uncollected payments is per customer.

And, as time goes on and your billing clerks continue to try and contact the customers, the billing system allows them to leave notes under each. This keeps everyone in the loop on the communication attempts and collections status for a better subscription management process.

Your Recurring Billing Software Should Offer More Than Just Billing Automation

A holistic recurring billing software does more than automatically send out invoices each month. It makes sure your business has the tools available to collect on those invoices, too. Because when your cash flow suffers, so does your business.

Powerful insights into your aging invoices are one of those tools, providing you with:

- all accounts receivable information in one place so nothing falls through the cracks

- a paper trail to keep the whole billing team up to date on the status of any particular customer’s payments, and

- detailed visibility for everyone, from your billing team to your business owners, executives, and stakeholders.

RELATED: Quick Dunning Message Tips to Optimize Your Collections Assurance

As long as ‘superpower’ is the buzzword around automation in the business world, we’ll happily hop on the trend. When it comes to collecting on your accounts receivable in your subscription business, automated billing software is the superpower that’ll help you stay ahead of it all.