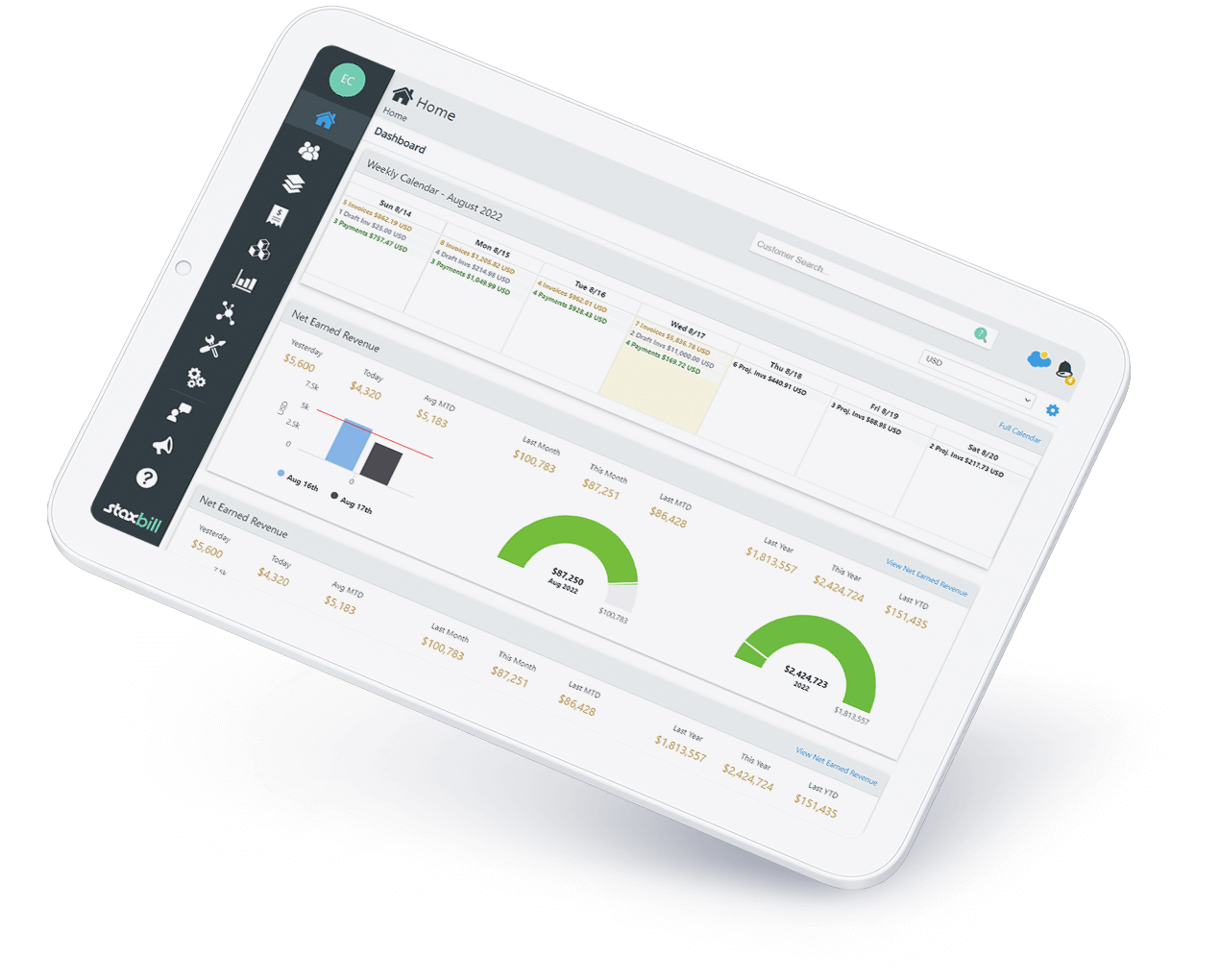

Stax Bill automates your recurring billing, subscription management, payment collection, and reporting to ensure you get the most revenue possible.

Subscription management

Effortlessly manage your subscriptions with Staxbill. You can automate and enhance your subscription processes seamlessly from dynamic pricing, custom registrations, structured account hierarchies, custom tracking, and more.

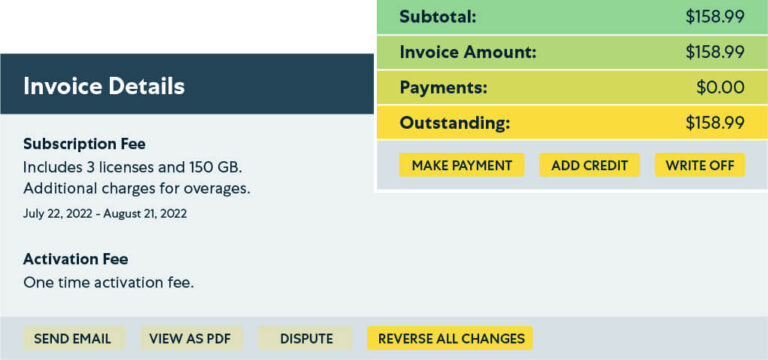

Recurring billing

Maximize growth with Staxbill’s recurring billing. Enjoy automated lifecycle communications, custom invoices, and smart automated pricing with accuracy.

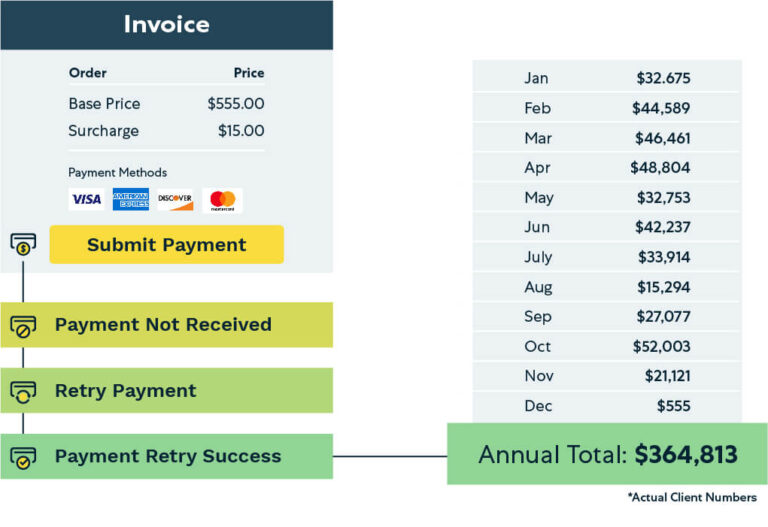

Payment collection

Enhance your payment collection with Staxbill. Boost revenue with automated dunning, insightful account receivables aging reports, and effective payment retries to reduce churn.

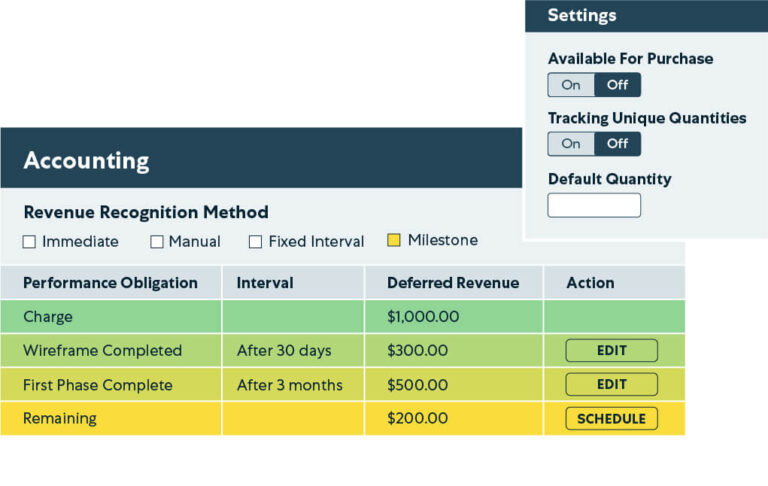

Revenue recognition

Stax Bill supports many revenue recognition options, including an advanced milestone module for ASC 606 compliance. We also have over 50 dynamic reports to track cash flow and identify revenue sources by product, plan, or customer, for any period. Gain clarity on revenue effortlessly.