MoviePass never had things easy. From product defects to radical and frequent shifts in price, the theatre ticket subscription service company’s journey was a bumpy one ever since its creation in 2011.

Still, at the beginning of 2019, the path toward a successful future seemed possible. A 200% surge in stock price helped to placate the fears of shareholders, while a film production project taken on by the company had been met with moderate success.

Yet trouble loomed.

In March of that year, the subscription company had to go back and admit it had improperly reported nearly $6M in revenue in the third quarter of 2018. It was an embarrassing public incident—one that certainly didn’t help MoviePass’s parent company Helios avoid being delisted from the NASDAQ.

This company’s reporting challenge is one that many other SaaS businesses can relate to. The accounting error that led to the incident had happened, in part, due to a failure to properly recognize subscription-based revenue.

MoviePass management stated that it “determined that a material weakness relating to subscription management existed in the company’s internal control over financial reporting,” a problem which persisted through December of that year.

But by the end of 2018, MoviePass had implemented a new software solution to solve the problem.

Using modern fintech for accurate reconciliation without the confusion

There’s something to be learned from mistakes of this kind.

Modern fintech software that supports double-entry accounting simplifies monthly account reconciliation so you can catch or eliminate problems before they occur. This helps prevent situations that are, at best, embarrassing and, at worst, disastrous to your business valuation, public image, and legal standing.

Accounting reconciliation and proper revenue recognition are not merely tasks to be completed at the end of every month: they produce insightful information that’s a testament to the health of your company.

When everything is going as it should, reconciled ledgers can attract investors and provide you with accurate data on the performance of your products. Juxtapose this with the embarrassment and legal ramifications that ensue from inaccurate reporting, and the importance of proper reconciliation and revenue recognition becomes apparent.

There are several common areas of confusion companies can run into during the reconciliation process—even when an adaptive, GAAP-compliant recurring billing platform is being used.

- Revenue recognition—which is the most common

- Monthly recurring revenue (MRR) forecasts

- Payment gateway fees

But with the right platform, you’ll have all the data you need at your fingertips to clear up any confusion and complete your reconciliation without issue.

1. Recognizing revenue for subscription-based earnings

The accounting department at any recurring revenue company is likely already acquainted with the unique challenges that stem from revenue recognition for subscription-based services. Indeed, complications in this department are quite common.

A recent report suggests about 60% of fraudulent accounting activities are the product of improper revenue recognition.

It’s also worth mentioning the standard for revenue recognition changed with the introduction of GAAP’s ASC 606. It’s now necessary for businesses to be able to track both their earned and deferred revenue for the entire subscription period.

For some businesses, revenue recognition is relatively straightforward. An eCommerce company, for example, can—with very little ambiguity—recognize revenue the moment its product has been delivered to a customer.

However, SaaS and other subscription companies often find themselves in the unique position of receiving cash that cannot be recognized as revenue for weeks, months, or even up to a year. Stir in reversals, discounts, etc., and the process of properly recognizing revenue is further complicated.

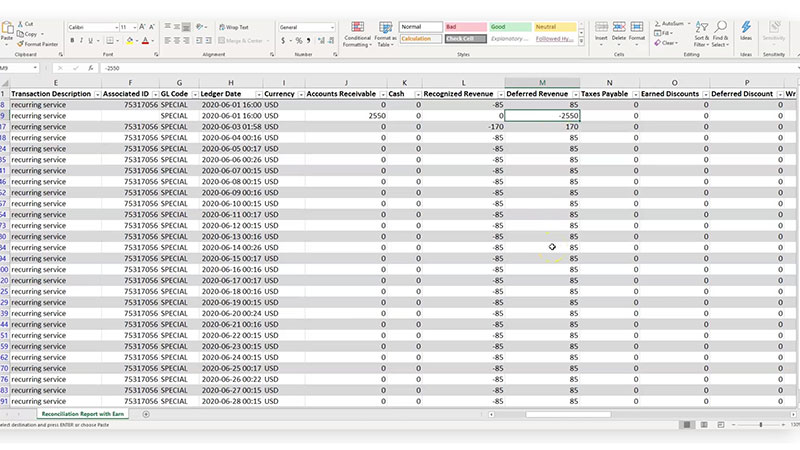

The double-entry accounting method that adaptive billing solutions like Stax Bill use provides clarity in complicated—yet fairly common—cases where, say, a customer cancels halfway through a year-long subscription.

In this situation, detailed deferred revenue records indicate exactly how much money you’ve earned over time in terms of services rendered so you can determine what sum is owed back to the customer.

Say a customer cancels their subscription fifteen days into a month-long agreement. In that situation, you can go back into your ledgers and find that your billing platform had been shifting 1/30th of the monthly fee from deferred to earned revenue each day.

If the subscription fee was $2,550 a month, the records will indicate:

- $1,275 earned, and

- $1,275 owed back to the client.

The data is all there, eliminating the possibility of accounting errors.

Depending on when your subscriptions start in a period and how your billing software recognizes revenue, your business’s recognized revenue may work on a different schedule than you expect.

- You might be looking at too small of a picture in terms of the period involved, or

- you might not be looking at the full picture in terms of the ledgers involved in all the transactions that are there.

In the case of the MoviePass incident, problems stemmed largely from the improper recognition of account revenue that had been frozen, pending customer approval of an increase in service charges. Company policy shakeups are one of the ways variables can confuse the revenue recognition process, but they’re also likely in the minority.

Often enough, reconciliation problems crop up from relatively simple mistakes—namely a failure to absorb the full picture of your ledger activity.

In short, when your end-of-the-month account reconciliation process identifies inconsistencies, revenue recognition issues are a likely culprit.

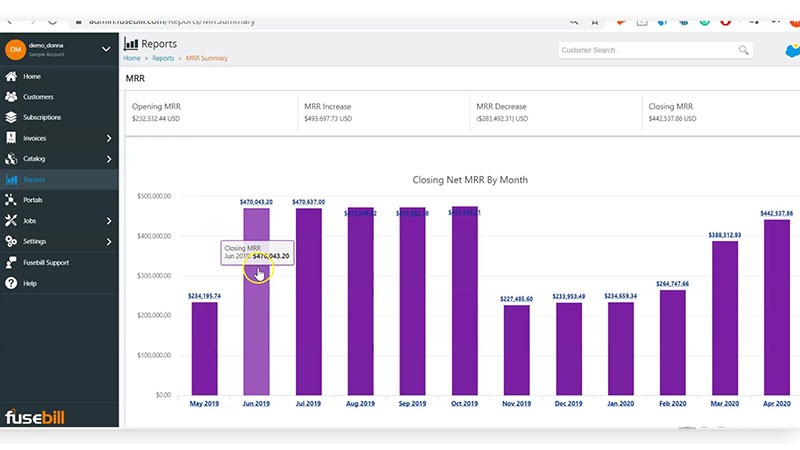

2. The problem with over-reliance on MRR forecasting

Though monthly recurring revenue (MRR) can be a fairly reliable way to predict incoming cash flow, it can’t provide a perfect forecast for what you’ll actually end up collecting.

There are many reasons why your expected MRR could differ from your month-end revenue reality.

- Sometimes customers don’t pay their bills. Credit cards tend to expire every three years, which means even reliable customers can default on their bill simply because their payment method lapsed without anyone’s knowledge. Other times, customers just don’t have the available funds.

- Did you take reversals and discounts into account? While these situations may be infrequent, they can cause very frustrating inconsistencies when it comes time for monthly reconciliation.

There are also quirky accounting situations that can crop up for subscription-based services. Some are quite common.

- A customer’s billing cycle may begin in the middle of the month, rather than on the first. This can complicate month-end reconciliation because the situation necessitates that half of their payment remains as deferred revenue until the completion of the service period—which would fall halfway through the following month.

As with many reconciliation hiccups, the money is all there, but the numbers perhaps haven’t been properly reviewed. Understanding when this income can be considered earned should clear up any confusion.

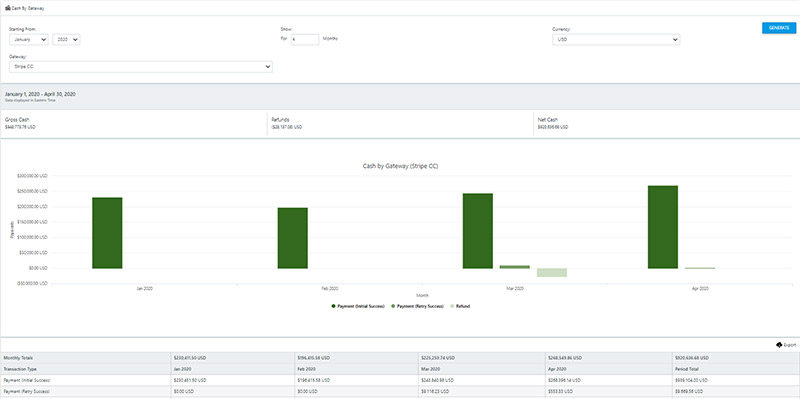

3. Accounting for payment gateway fees

The gateway is the company that helps direct customer payments to your bank account—but not before taking a fee off the top of each exchange.

Though gateway costs don’t usually account for a major discrepancy between the sum that shows up on your billing platform ledger and the one that winds up on your account, it’s nevertheless a factor that can cause reconciliation confusion at the end of the month.

Stax Bill will have a record of all of your transactions, but because the gateway collects its fee, that number will ultimately be slightly different than what winds up in your account.

The solution is simply to take these accumulated fees into consideration as you balance your ledgers—otherwise, you may be left scratching your head at the end of the month!

Adding ease to the monthly reconciliation process

The above considerations can be used to troubleshoot a significant portion of month-end reconciliation confusion. Frustrating though hiccups may be, the fortunate news is that most month-end complications stem from relatively simple oversights that can be quickly resolved with the help and data provided by a reliable double-entry ledger solution.

You may have to do a little bit of digging through the data for the purposes of reconciliation. But the clean, user-friendly interface of the platform and comprehensive data export options makes it easy to catch problems once you understand what might be causing them.

Though subscription-based billing can have its share of accounting road bumps, knowing where to look when a problem or confusion does crop up will go a long way towards making month-end account reconciliation quicker, easier, and pain-free.