No doubt—the bigger your SaaS business, the more complicated its revenue recognition requirements.

If you’re here, you probably already know that. You also already know that if you have any hope of achieving proper and compliant recognition, you’ll need some technological help.

The simplest form of assistance is an integrated, ASC 606-compliant billing automation solution. This allows you to do everything automatically. From just one platform, you can:

- send invoices,

- receive payments, and

- accurately recognize your revenue

…all with virtually no chance of error.

Here’s what this looks like in action.

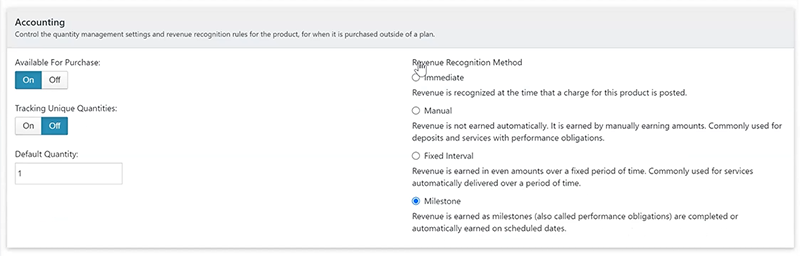

ASC 606 compliance requires support for all four revenue recognition methods

Different businesses use different methods for recognizing revenue. It all comes down to how a business’s performance obligations are outlined in its customer contracts.

Under ASC 606 guidelines, there are four ways a business can compliantly recognize revenue, and a fully compliant software will automate any and all of these methods. Each of these methods is more complicated than the last.

1. Immediate revenue recognition

As the name implies, businesses following the immediate revenue recognition method recognize revenue, well, immediately after receiving it.

For businesses that deal in one-time charges, this is obviously the most common revenue recognition method. But how does it work in the world of subscriptions?

You’ll probably at least partially recognize revenue immediately if you are:

- an IoT business that sells physical products, or

- charging customers for one-off services such as setup fees.

In cases like these, you’d recognize the revenue from your one-time charges immediately. Any accompanying subscription fee would be recognized on a schedule.

2. Manual revenue recognition

We’re all about automation, but there are some situations where SaaS businesses may choose to manually recognize revenue. This includes:

- If your business is charging its customers a deposit.

- If your business is unsure of when its next performance obligation will be hit.

In the second case, your software can call your billing platform via API after you successfully hit a performance obligation.

Either way, if you set your revenue recognition schedule to ‘manual’, the money will sit in the deferred revenue bucket until someone manually acts upon it.

3. Fixed interval revenue recognition

A fixed interval or time-based approach is one of the most common methods of recognizing revenue for SaaS and other subscription businesses. With this approach, the same amount or percentage of revenue is recognized every cycle.

So, if you sign a customer on a $12,000/year contract, you can set your system to recognize $1,000/month every month for the entirety of the year. You could also set up a daily, weekly, or quarterly revenue recognition schedule depending on your performance obligations and the nature of your business.

4. Milestone revenue recognition

The milestone method is the most complicated one, as you’d be recognizing your revenue on a very customized and irregular schedule. The intervals and the amount of revenue recognized in each instance don’t have to be standardized, like on a fixed-interval schedule.

If you close a $10,000 deal, you may choose to recognize:

- $1,000 on receipt of payment,

- $2,000 at the end of month one,

- $5,000 at the end of month six, and

- $2,000 at the end of month twelve.

A business may go this route if it knows it will hit its performance obligations at specific, yet irregular intervals throughout the contract.

Advanced revenue recognition support in Stax Bill

Stax Bill’s subscription billing software has always offered support for SaaS and subscription businesses when it comes to recognizing revenue with ASC 606-compliance.

In our latest product updates, we’ve greatly enhanced our existing capabilities to bring our revenue recognition module into full ASC 606 alignment. We’ve ensured support for all the different revenue recognition methods and more.

That means—in our humble opinion—Stax Bill is the only tool your business needs to recognize its revenue automatically and 100% compliantly.

Here’s why:

5. Built-in ASC 606-compliant revenue recognition module

Our enhanced revenue recognition module is built into the Stax Bill platform. There’s no separate integration to set up.

Similarly, the module is available to all Stax Bill users and included across all plans. While some billing platforms may charge extra for a revenue recognition module, we don’t.

And, of course, it’s fully compliant with ASC 606 standards.

Just as with billing and invoicing, all you need to do any time you enter a new customer contract is set your revenue recognition schedule and parameters. The system then takes care of it for you, automatically.

6. ASC 606-aligned terminology

Verbiage within the platform has been updated to align with the terminology used in ASC 606 guidelines. Before, certain capabilities may have existed, but the wording may not have been what you’re used to seeing in an ASC 606 context.

This is part of our commitment to simplifying revenue recognition through automation.

7. Integration with your ERP

From day one, Stax Bill has been a ledger-based billing platform. We speak the accounting language, and we know how important it is that any earned and deferred revenue activity feeds from your billing software into your ERP or accounting platform.

We integrate natively with NetSuite and QuickBooks Online, and have an API available for any other systems to do exactly this. Revenue is recognized automatically in your billing system according to the schedule you set. It can then reflect in your ERP or accounting software to make sure your ledgers are balanced across your fintech stack.

Recognizing revenue without lifting a finger

Revenue recognition is a business process your team simply can’t handle manually. While nearly any revenue recognition module could make the job a bit easier, an automated, ASC 606-compliant module alleviates almost all the work. It also removes almost all margin for error.

While recognizing revenue is important for any business, there are likely more tactical projects your billing team could be working on. By strategically leaning on your tech stack, everything can get done—and get done well.