In the transactional—or as some say, traditional—business world, owners have tried and true methods for growth.

- Sell more of your product or service.

- Build/develop/add more products or services to sell.

Yes, this is simplified but it does capture the nature of the transactional-based business. Both of these methods concentrate on the ‘what’ and the ‘how many’—they’re both entirely product focused and the customer is almost incidental.

To measure the growth created by these methods they rely on product based metrics such as:

- number of units

- average selling price, and

- annual gross revenue.

In the subscription world, the focus shifts to one that’s much more customer-centric. Growth hacking is measured in terms of the number of customers acquired (and kept). Strengthening the relationship with these customers becomes paramount as the longer the relationship exists the longer you’ll collect the recurring revenue and the more chances you’ll have to increase the amount the customer spends with you every month, quarter, year, etc., depending on your billing cycle.

Suddenly, not only do the transactional world’s growth methods no longer apply to subscription-based businesses, but neither do their SaaS growth metrics.

The following are three of the key business metrics for measuring and monitoring the growth of a subscription business.

Customer acquisition

This should include a current count of all customer entities as well as run rate information based on the creation date of customers within the last calendar year.

For a complete picture, your customer acquisition metrics should include both a customer primary count—which is comprised of all customer entities, regardless of status—as well as an active count—which only includes customer entities in status approved, credit card warning, and hold.

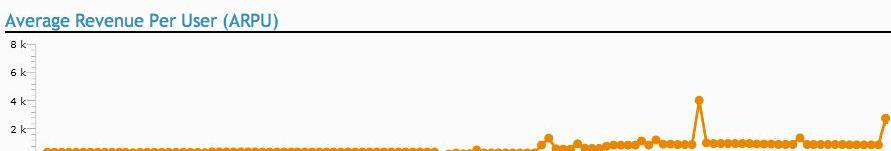

Average revenue per user (ARPU)

You should be able to monitor your monthly ARPU by day. Monthly ARPU is calculated as the earned revenues divided by the number of active customers. ARPU is most influenced by the mix of subscriptions your customers have and adding subscriptions to higher value price plans will increase ARPU while adding customers who don’t have subscriptions, or who are subscribed to free plans will with no subscriptions, will decrease ARPU.

To calculate ARPU: (The Days MRR + The Days One Time Fees) / Active Customer Count

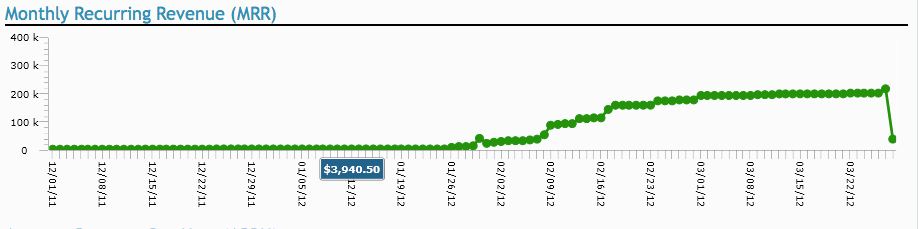

Monthly recurring revenue (MRR)

When measuring MRR, your report should show only the recurring charges that are earned in the month (one-time charges like setup fees are not included) in order to be a true indicator of future revenues from your existing customer base. Additional customers, higher value plans, and recurring add-on components will all make MRR increase.

MRR Calculation Details: MRR is the effective monthly revenue from all active recurring subscriptions under the account.

Example: A $10/monthly plan = $10 MRR. A $120/year plan = $10 MRR.

While there are other growth metrics that should be monitored in order to keep a finger on the pulse of subscription businesses, being able to quickly and easily reference your customer acquisition, ARPU, and MRR numbers will help you meet your growth goals.