The subscription business model is a fantastic predictor of stable and continuous revenue in many ways—when customers are paying you a monthly or annual subscription fee, you have a pretty good idea how much revenue your business will be pulling in for any given period.

But, if your business isn’t using the right fintech tools to manage your revenue engine, your processes probably aren’t running as efficiently as they could be.

If you want to see recurring revenue growth, you need to continually optimize your financial operations to create the most efficient and scalable billing and collections processes.

And if not? It’s possible you’re not maximizing that revenue engine.

Many subscription businesses start out managing their billing using webs of spreadsheets or software solutions not meant for recurring billing at scale. They don’t realize initially how much this is costing them—both in time and in revenue leakage.

As an example, construction projects management software provider CoConstruct was handling its recurring billing using an ecommerce module in its CRM. But as the business scaled, it became a challenge to stay on top of things like accurate taxation and collections assurance.

When the business transformed its processes with a modern, adaptive recurring billing software to support its growing FinOps needs, it began putting $2,000 back on its bottom line each month. And it didn’t stop there—the business was also able to save around 40 hours a month on billing-related tasks and reallocate that time to new growth initiatives.

Talk about return on investment!

5 Ways automated recurring billing software produces ROI for subscription businesses

Back-office functions such as accounts receivables and recurring payments are often overlooked as businesses digitally transform. But this is a core part of your business’s revenue engine and should be given as much priority as your shiny new marketing and sales tech.

And if there’s one takeaway from the example above, it’s that the adoption of an automated billing system saves businesses so much time and money, it pays for itself.

So where exactly does the ROI from recurring billing software come from?

1. Dunning management features and functionality.

To run a successful recurring billing business, you need to make sure your customers don’t just receive their invoices—they also pay them!

Modern billing platforms know this and have invested accordingly in the development of comprehensive dunning management features and functionality.

- Credit card auto-updating, where the software communicates with the major credit card brands to proactively update any expired payment methods

- Automated dunning emails that get triggered to notify customers of overdue invoices

- Automated collection reattempts that re-run credit card payments on a pre-set schedule after a failed transaction

- Detailed accounts receivable aging reports enable you to see which customers have overdue invoices and how long payments have been outstanding. You can also set the likelihood of receiving any given payment and add notes to make sure your whole finance team is in the loop.

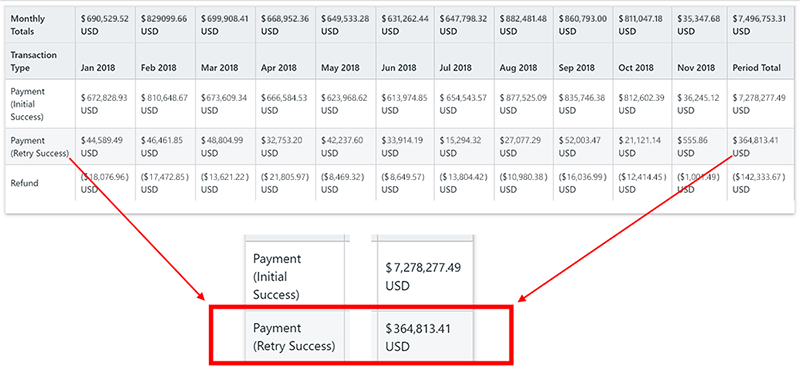

And these tools are effective.

On average, when subscription businesses switch to a recurring billing system, they see between 2% and 4% of their recurring revenue put back on their bottom line thanks to dunning management features and functionality alone.

Software development company and BaaS provider BitHeads saw huge returns when it began automating its dunning management process. It now recovers between 5%-10% of its MRR—an amount it would have otherwise had to write off.

We told you the software pays for itself, didn’t we?

2. Eliminating costly human errors.

Humans make mistakes—it’s inevitable. But when human error shows up in your recurring billing process, it can be especially painful.

Often, when businesses are invoicing their subscribers manually, mistakes can mean they either:

- overcharge customers for their subscription product or service and harm the customer relationship, or

- undercharge customers and lose out on revenue until someone notices and corrects the error.

And if your subscription business deals a lot in variable recurring billing, where the amount billed each period fluctuates based on usage, etc., your margin for billing errors increases.

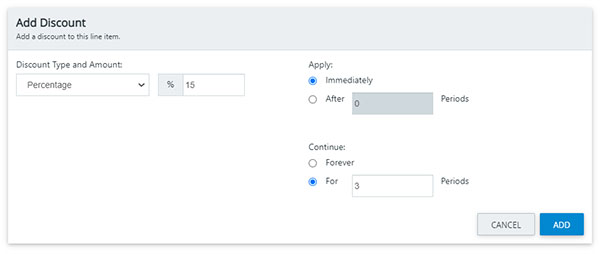

We also see a lot of businesses forgetting to remove expired discounts, which leads to a lot of revenue leakage.

All these outcomes hurt your business.

Taking the manual effort out of the equation and automating key financial processes like recurring invoicing and subscription discount management ultimately protects your business against the churn and revenue leakage that results from human errors.

3. Redirecting team effort and hours.

And, of course, with fewer recurring billing tasks to do by hand, your finance team frees up time to work on more strategic projects for your business.

Switching to automated recurring billing can reduce the time spent invoicing by up to a whopping 80% or more than 40 hours a month.

How much is that time worth?

Human resources software platform JustLogin was able to reduce its two-week monthly billing process down to just a couple of hours after adopting an automated recurring billing software solution. The business saw a 90% gain in billing efficiency. And as a result, it was able to triple its growth without needing to hire additional employees.

4. Creating a reliable financial system of record and SSOT for accounts receivables.

If your subscription business isn’t using a modern recurring billing solution, you’re likely missing a reliable financial system of record. Recurring revenue businesses create a lot of data, and if this data is fractioned, with different pieces housed in different places, it can create a lot of problems: duplicated and conflicting information, missed or incorrect bills, and disrupted access to services—all culminating in unhappy customers.

Your billing software serves as your financial system of record and can also function as your single source of truth (SSOT) around accounts receivable data. This is the one-stop-shop that any of your employees can go to for reliable, up-to-date data that can enable them to do their jobs better.

A reliable financial system of record and SSOT provides:

- Uniform data—when multiple departments within your organization are communicating with clients (say, sales, customer service, and customer support), guaranteeing everyone has access to the same product, plan, pricing, and subscription information helps your teams work more accurately and efficiently and ensures a positive customer experience.

- Comprehensive customer history—the right system provides your customers’ account and transaction histories, payment success rates, and any subscription movements. This is helpful for everyone from your finance team in the event of an overdue invoice to your support team should a customer call in for assistance, and even your sales team when it’s time to work on upsells and customer renewals.

- Product and plan performance insights—with reliable data on the best-selling products, plans, and billing frequencies in your catalog, your sales and marketing teams have deep insight when crafting strategic promotions and offerings that will drive new business.

Don’t underestimate the effects of such reliable, in-depth data. When actioned correctly, these analytics can be instrumental in the growth of your business.

In fact, a 2021 PwC study showed businesses using data to drive operations can outperform competitors by 5% in productivity and 6% in profitability.

5. Managing subscription plan migrations with efficiency.

If a customer wants to upgrade or downgrade their subscription plan, things can get a little messy on the back end if your finance team is handling it by hand.

If this happens in the middle of a fixed recurring billing cycle and your team is making the changes correctly according to revenue recognition standards, it can get complicated. Any still-unearned revenue from the first plan needs to be reversed in your ledger, and revenue for the new plan needs to be prorated.

And as you can imagine, this is a time-consuming task with a high potential for error if done manually.

There’s a much simpler and more common way many businesses get around the complicated work: canceling the existing subscription and signing the customer up for a new plan. The problem with this? It causes inaccuracies in your month-end reporting, with plan migrations showing up incorrectly as false churn.

- A modern subscription billing solution takes care of all of this automatically in just a few seconds.

- Your subscription business’s reporting stays in line with revenue recognition standards.

- No revenue slips through the cracks in the meanwhile.

And, when you set up clear subscription plan families and a customer self-service portal through your billing platform, your subscribers are empowered to handle these migrations on their own. That means they can grow with your business exactly when and how they need to, and you can essentially automate the process of farming your current customer base.

Recurring billing software puts money on your bottom line

The recurring billing model has seen unprecedented popularity in the last decade because of the revenue predictability. But with the wrong fintech tools—or no tools at all—subscription-based businesses can easily fall victim to revenue leakage at the hands of human error or human limitation.

Modern recurring billing software not only patches up those leaks but puts money back on your business’s bottom line.

It’s one part of your digital transformation that pays for itself…and then some.

Quick FAQs about ROI

Q: What is the ROI from automated recurring billing?

On average, when subscription businesses switch to an automated recurring billing system, they see between 2% and 4% of their recurring revenue put back on their bottom line.

Q: How can automated recurring billing enhance revenue growth?

By continually optimizing financial operations to create efficient and scalable billing and collections processes, businesses can enhance their recurring revenue growth.

Q: What is the impact of not using the right fintech tools for managing recurring billing?

If businesses are not using the right fintech tools, they may not be running their processes as efficiently as possible, potentially leading to revenue leakage and decreased efficiency.

Q: How do modern billing platforms aid in successful recurring billing?

Modern billing platforms have invested in comprehensive dunning management features and functionality, including credit card auto-updating, automated dunning emails and collection reattempts, and detailed accounts receivable aging reports.

Q: What are the benefits of automating the recurring billing process?

Automation reduces errors, protects against churn and revenue leakage, and can reduce the time spent invoicing by up to 80% or more than 40 hours a month. It also provides a reliable financial system of record and a single source of truth around accounts receivable data.

Q: How does automated recurring billing software handle subscription plan changes?

Modern subscription billing solutions handle subscription plan changes automatically in just a few seconds, ensuring that reporting stays in line with revenue recognition standards and no revenue slips through the cracks.

Q: What are the repercussions of human error in the recurring billing process?

Human error in the recurring billing process can lead to overcharging or undercharging customers, harming customer relationships and causing revenue loss.

Q: How does automated recurring billing software prevent revenue leakage?

By automating key financial processes like recurring invoicing and subscription discount management, businesses can protect against the churn and revenue leakage that results from human errors.

Q: What is the effect of using automated recurring billing software on business growth?

Businesses using data-driven operations, facilitated by automated recurring billing software, can outperform competitors by 5% in productivity and 6% in profitability, according to a 2021 PwC study.

Q: Why is it essential to have a reliable financial system of record for a subscription business?

A reliable financial system of record ensures uniform data across departments, provides comprehensive customer history, and gives product and plan performance insights, all of which are crucial for efficient business operations and growth.