Let’s say you have 100 customers, all paying $100 a month for your subscription product. That’s $10,000 monthly, or $120,000 annually.

On paper, things look great. And in practice, your monthly collection process almost always runs smoothly.

But 2% of your customers don’t pay on time. So even if 98% of your customers typically do pay on time and in full, it still means about 2% of your revenue is slowly leaking away each month due to failed payments.

That adds up over time.

After a year, you’ll have lost $2,400, after two years $4,800, and so on and so forth with losses continuing to grow each month. And that doesn’t even take into account a growing base of paying customers and potentially increasing amount of revenue leakage, nor does it include the cost of losing recurring revenue due to churn after payment failure.

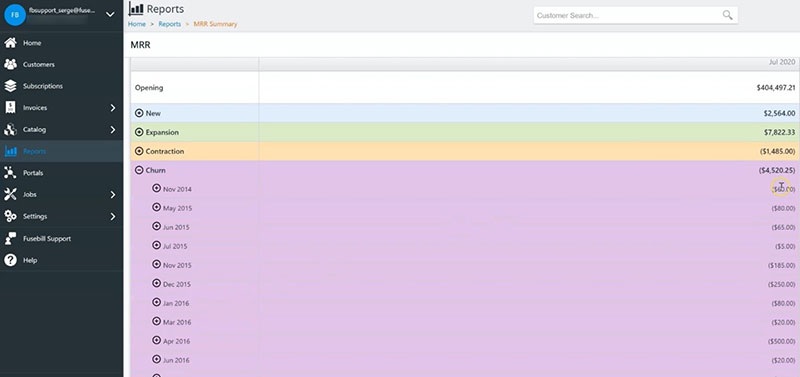

For subscription-based businesses, maximizing collection assurance is imperative to stabilize and continuously increase monthly recurring revenue (MRR).

This means reducing your aging receivables—money that has less and less liquidity, and less and less chance of being converted into cash.

The role of the billing process in revenue operations and true digital transformation becomes evident in the way processes like dunning management tie into customer satisfaction, churn, and revenue recovery.

An effective dunning management strategy coupled with advanced automation tactics can help accomplish this while also reducing churn.

Here are 3 steps you can take in this direction.

1. Automate Collection Retries and Reap The Benefits of Dunning Persistence

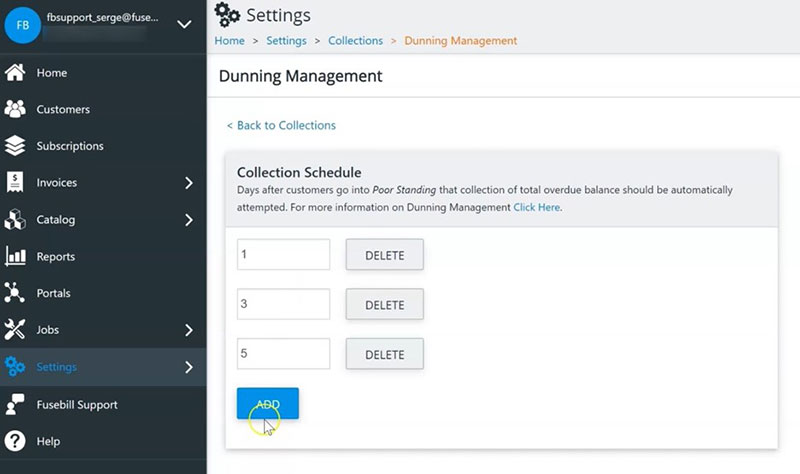

One of the most pain-free methods of dunning is simply to retry your failed collection attempts at a later date. For example, if you usually collect on the first of the month, you may find it prudent to automate reattempts on failed payments three and five days after your initial attempt.

Extending second and third chances to customers’ accounts addresses one of the most common causes of payment truancy: credit card issues.

Often enough, when a payment fails to go through—especially in the B2C world—it’s because your customer’s credit card is overdrawn or expired. But while they may have been short on the first of the month, the situation could be improved by the third or the fifth.

By automating follow-ups, you:

- improve your odds of collecting the revenue

- maintain a good relationship with your customer, and

- avoid churn due to payment failure.

Customer churn makes it very tough to enjoy consistent, stable MRR growth.

When customer accounts are closed out for missed payments, you don’t just lose the money you were owed, you also close the door on months or even years of recurring revenue.

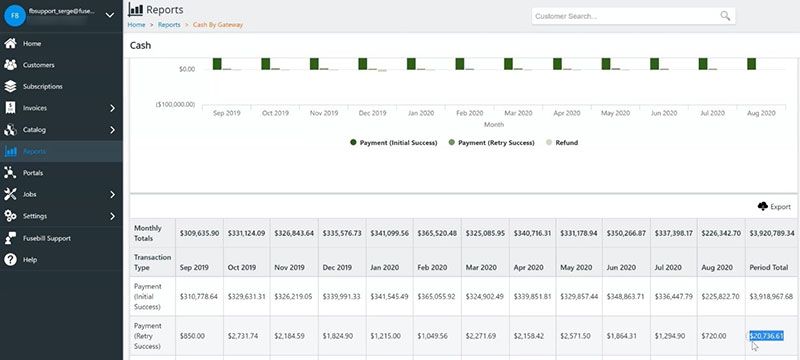

So, when it comes to working directly with consumers, a little bit of patience can go a long way. If you can maximize your collections and reduce your churn rate with a few tweaks, it’s a great growth opportunity. In the below image you see an amount of $20,736.67 recovered by successive dunning retries.

2. Automate Communications to Solve Payment Issues With Ease

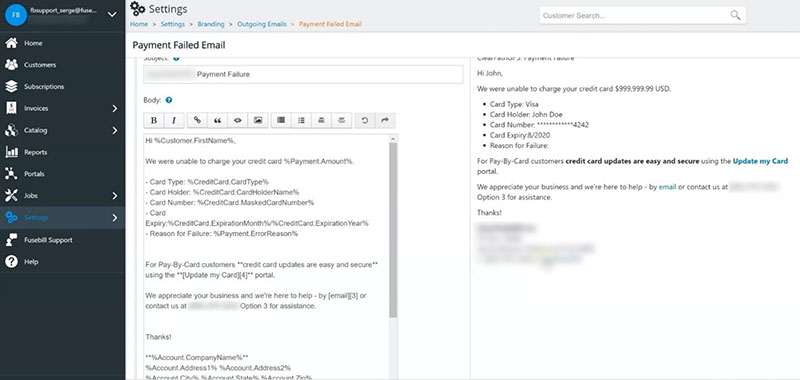

Notifying customers about payment failures helps expedite the collection process in both B2C and B2B scenarios.

Informative, automated email outreach simplifies the experience on both ends. And when done correctly, it gives customers an easy, barrier-free way to resolve their payment issues.

An effective dunning outreach attempt should:

- succinctly—and politely—explain the situation

- provide a link or point of contact so the customer can resolve the issue, and

- create a customer experience that’s as easy and pain-free as possible.

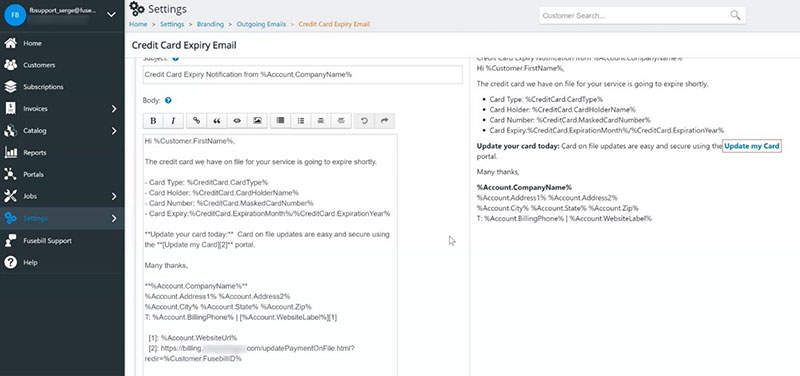

Preventive measures can be done similarly. For example, you may find it helpful to send courtesy emails to your customers a month in advance notifying them their credit cards are set to expire soon. In doing this, you may be able to prevent problems before they ever occur.

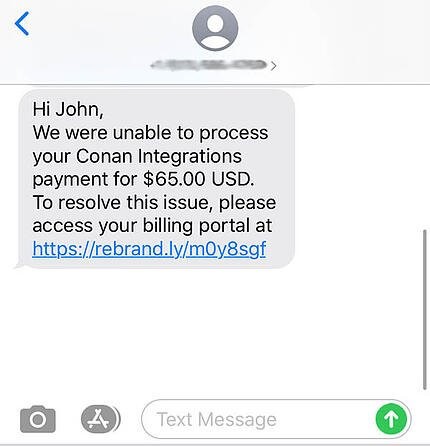

Perhaps even more effective than email outreach is text message communication.

While only 22% of emails are opened, text messages benefit from a much higher engagement rate of 98%.

Text messages are also addressed far quicker. It takes about 90 seconds for someone to respond to a text, whereas the average for email responsiveness—in the apparently rare circumstance that the message gets opened in the first place—is closer to an hour and a half.

Keep in mind correcting a credit card payment problem probably isn’t a job your customers will enjoy, so the easier you make things, the better your odds of dunning success become.

Of course, without automated billing software, these tasks become significantly more complicated. Manual dunning—including collection retries and customer communication efforts—is both time consuming and error-prone.

By automating, you guarantee an efficient, accurate process that requires very little time and effort on the part of your business. It also creates a smoother, more professional experience for your customers.

3. Perfecting Your Dunning Efforts

So you’re communicating with your customers and you’ve automated your collection retries. What else can your subscription business be doing to achieve the best collections results?

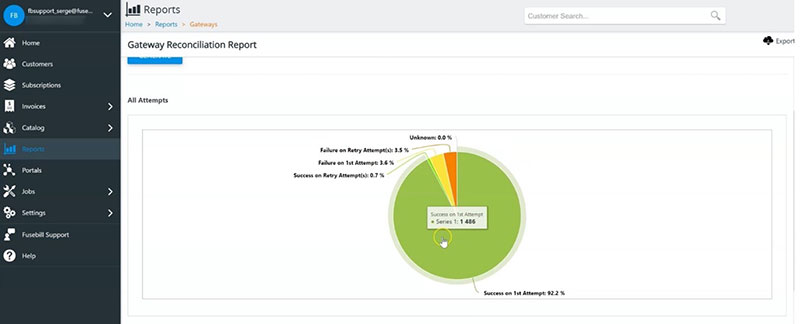

Of course, we’d be remiss to ignore the benefits data digging can have on your dunning efforts. By doing some reporting, you can find out important information such as:

- how often payments are collected on the first attempt

- what follow-up strategies work the best when payments are late, and

- how failed payments affect your business’s churn rate.

Keep in mind that occasionally taking the time to review who’s leaving (and why) can provide you with valuable insights into your business model, while even allowing the possibility to bring clients who’ve churned back into the fold.

Additional efforts may include allowing for an extended payment grace period. Giving your customers more breathing room may become especially effective when coupled with additional payment retries.

For example, if you were attempting to recollect three and five days after the initial payment failure, you might find enhanced success by adding collection attempts fourteen and twenty-one days after your initial attempt.

This is particularly helpful for businesses dealing directly with consumers as the broader period gives customers more time to get paid and settle their debts.

And sometimes, a little more time makes all the difference between you getting paid or not, and the customer staying with your business or churning out because their account went into poor standing.

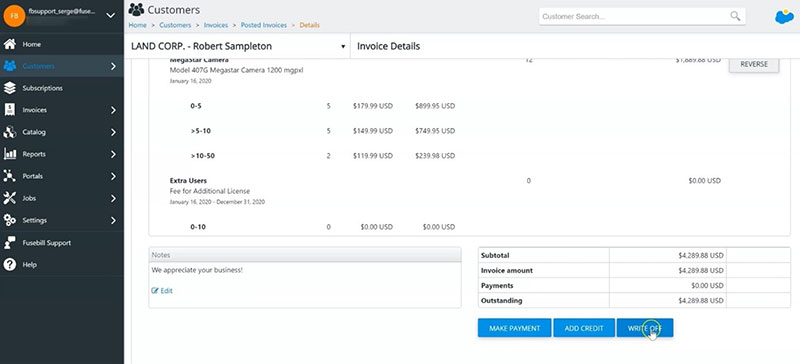

When all else fails, your billing clerks may need to take some manual action, reaching out to customers with outstanding invoices to try and find out what’s going. Sometimes this final effort yields results, while other times you might be dealing with a lost cause.

When there’s no hope of payment collection, flagging the truant account becomes necessary. At this point, the decision becomes whether you should pass the debt off to a collection agency—and hope to at least make some pennies on the dollar—or write off the invoice, absorb the loss, and move on.

Dunning Your Way to Success

Unfortunate as this final scenario is, effective and automated dunning procedures can make it a significantly less common occurrence. Automated collection processes coupled with strategic policies can go a long way toward retrieving owed money and reducing customer churn.

As far as growth strategies are concerned, there are very few ways to stabilize and boost your MRR that are as affordable, effective, and hands-off as a good automated dunning process.

Optimized dunning management plays an important role in revenue operations and digital transformation

By rethinking the way you view truant payments and revamping the way you collect them, you can maximize your collection assurance, reduce churn, and pave the path to improved revenues and growth.

Also see: