As the business world stepped into the subscription commerce era and adopted the recurring billing business model, companies discovered that they can attract more customers by lowering the price threshold for their product. They could now bill a customer for smaller payments for that product instead of one bigger, upfront payment. This lower barrier-to-entry-pricing reduced friction in the sales process, yielding a larger market for the business.

When they first open their e-commerce doors, these businesses may attempt to use their own in-house resources to meet billing needs. Often, spreadsheets are put into service for the task. As the business grows, this approach becomes difficult to sustain, and can lead to costly errors, lost revenue, or customers churning out.

With a subscription-based business that bills on a recurring schedule, the billing process plays a crucial role in preventing these issues and ensuring predictable monthly recurring revenues.

Below are 8 of the top ways that can streamline your billing and customer communications to bulletproof your business.

1. Improving time management

With the manual method of tracking your billing, you had to negotiate through an ever growing spreadsheet to track your customer information. This labyrinth of information meant that you had to manually look up every customer, determine the product they were buying on a recurring basis, and bill out accordingly.

Invariably, customers would want to make changes and you had to manually track each new add-on, product removal, and customer update, whether it’s a new location or updated email information for the individual you need to bill.

An agile recurring billing platform gives customers the freedom to change their own preferences. They can upgrade or downgrade their subscription, change users and update billing information. Instead of your staff having to make these changes manually, the platform does it automatically, reducing the time you or an employee has to spend in order to effectively prepare the invoice.

2. Making pricing changes fluid

The marketplace is constantly undergoing change. If you’re selling an item that needs to be manufactured, prices will reflect labor charges as well as fluctuating prices for the raw materials to build those items.

In the SaaS world, prices might need to be adjusted for a number of reasons, including competitor pricing or internal pricing changes, such as reduced-price trial periods.

Without a modern recurring billing platform, every change needs to be made on an individual basis, which increases the potential for human error. However, an effective means to track recurring billing ensures that every change on a price point is updated quickly and transfers throughout the billing platform so that every customer is billed appropriately.

3. Improving communication

A robust billing system is essential in facilitating communication between a business and their customers. Of course, you need to send out invoices during a billing period, but you also may need to send out friendly reminders that a bill is past due.

When you are using a subscription management and recurring billing platform, these invoices are sent out automatically. But that’s only a small part of the communication puzzle.

You can also send customers reminders through the platform’s dunning management system to alert them when there is a problem with their payment method during the billing cycle. You can even give them a heads up that their credit card is about to expire, which could secure an alternative payment method well before the invoice is due.

4. Improving customer relations

The customer relationship is essential for any successful business transaction. Historically, the traditional sales environment meant that the relationship with a customer needed to be nurtured until the transaction was complete. As soon as a payment was made, it often didn’t matter (to the business) if the healthy business-customer relationship was sustained.

However, the subscription billing business model empowers the customer, insomuch as there is a continued relationship between both parties. Now, the recurring billing business (i.e., sales, customer management team, etc.) is held to a long-term commitment.

The purchase goes beyond a potential money-back-guarantee for a singular purchase, and impacts recurring revenue through the remainder of customer lifetime value, which can be months, years, or even decades.

It is essential to keep that relationship steady through a variety of communication methods, whether that communication is necessary and expected or unanticipated.

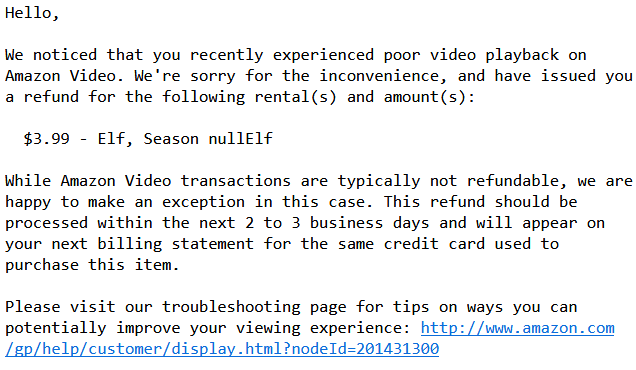

For example, a long-time Amazon customer expects a high level of customer service. The customer might not even notice much of a hiccup in a video streaming episode, but an email such as this proves that their Amazon purchase is secure:

5. Reducing churn in the recurring billing business

This goes hand-in-hand with the above points. If your customers are satisfied with your product and your service, it will go a long way in maintaining that relationship and avoiding the dreaded churn.

For SaaS companies, that churn rate can be around 5% to 7%, but that number can vary greatly depending on a number of factors. Some estimates put the cost of attracting a new customer at as much as 25 times more expensive than retaining a customer. Therefore, it’s critical to your company’s fiscal health to do everything you can to keep your customer level intact.

Unlike with manual billing, which might not identify a churn risk until it’s too late, a recurring billing platform automatically monitors potential problems, provides easy access to insightful financial reports, and recovers revenue by sending out reminder communication regarding unpaid invoices and retrying failed credit card payments.

6. Preventing revenue leakage

Revenue leakage occurs when there is potential revenue that a business fails to capture. For example, a business that offers a limited time discount, such as a 30-day free trial, might not end that discount after the month. Thus, they lose the income they should have secured.

Think about businesses that only bill on the first of the month because they still use manual billing systems. What if a customer starts in on the 14th of the month? That is at least 15 days that the business loses out on revenue.

In the telecommunications industry alone, one report finds that between 1% and 3% of revenue is not billed, while 2% to 6% of billed revenue remains unpaid.

What might start out as a few customers not being billed properly can quickly become a major issue, particularly when a company is in the process of scaling and can’t keep up with the demands of growth.

With a subscription billing platform, a business can easily access data reporting, API integration and third party vendors to ensure that all facets of potential revenue are being monitored.

7. Accurately monitoring revenue recognition including deferred vs earned revenue

Revenue recognition can be a tricky thing to monitor, but it is extremely important to follow Generally Accepted Accounting Principles (GAAP) to differentiate between deferred and earned revenue.

Subscribers to a SaaS business such as Adobe pay for their subscription at the beginning of the month, for example. That payment is considered deferred revenue, since the customer has not yet used the software that month. As the month progresses, though, that revenue changes incrementally from deferred to earned revenue.

Keeping track of both deferred and earned revenue can be tricky to do manually, but the task is simplified exponentially when using a recurring billing platform that supports accurate revenue recognition.

8. Providing valuable insight into subscriptions

Reporting on a granular level is essential in monitoring the health of your business. It shows the financial performance of the company, comparing snapshots in time, from month to month, quarter to quarter and year to year.

Through reporting, a business can gain essential insights into the health of their company, allowing them to make more informed and valuable fiscal and organizational decisions.

All in all, a comprehensive recurring billing platform helps businesses save time and money, while providing them with the tools to manage customer information, improve communication, and scale their company without the challenges that crop up with manual billing processes.

If your organization is struggling with the growing pains of scaling, while also keeping your customers happy and satisfied, it might be time to turn to a subscription management platform that will help you optimize your business for growth.