When a global crisis hits, the effects can have short and long-term repercussions on individual businesses as well as on the world economy as a whole.

As business operations shift and sputter, stocks can begin to plummet and forecasts for future quarters can start to look bleak. Governments work away at injecting money into the marketplace when situations like this occur, but it often doesn’t come quickly enough to support everyone in the business world.

In the midst of recessionary times, many recurring billing companies will likely encounter clients looking for insight into how they can temporarily defer, adjust, or even delay their invoicing and payments. We’ve put together a list of nine features in Stax Bill’s recurring billing platform that can help users find solutions to accommodate the needs of their customers.

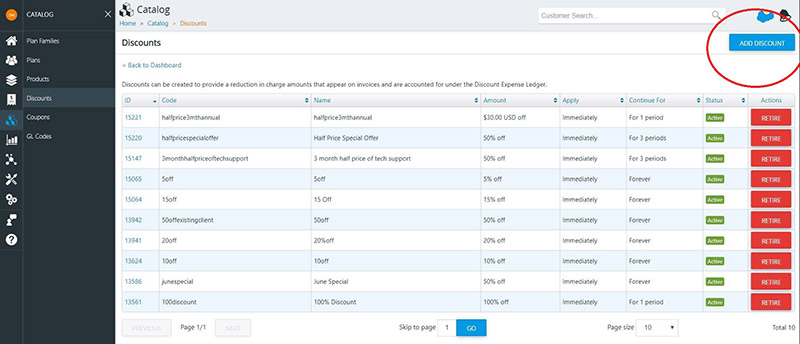

1. Provide limited duration subscription discounts

One way to provide your customers with a low-effort bit of relief is to provide individual customers with limited-time discounts. It could be just what they need in order to keep their account going.

In each subscription on a customer, there are subscription products. And on each of those subscription products you can add a discount.

Your business can set a specific discount amount and timeframe for that discount in order to reduce the charges generated by invoices.

The timeframe you set counts down by billing periods until the discount starts and is then applied for the periods remaining. For example, on a monthly subscription, you can have a discount apply to a specific product next month, but not on any of the already posted invoices.

When you apply a discount to a customer’s subscription, it will only affect new charges generated by the subscription products that are affected by the active discount.

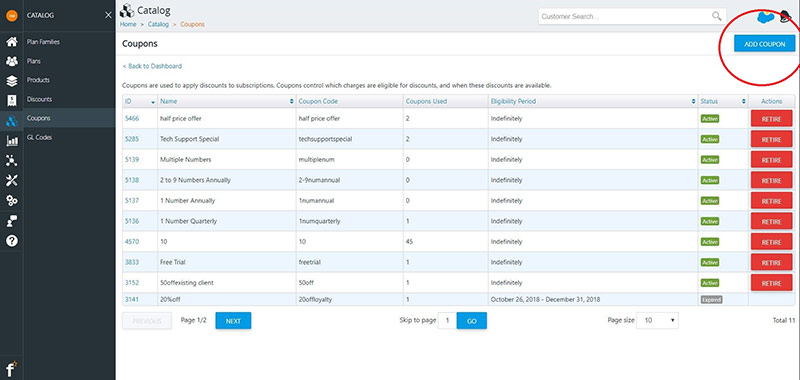

2. Create coupons to apply discounts

Another option to offer discounts to your customers is by creating and administering coupons. If you find yourself applying the same discount over and over, setting up a coupon can make this easier for your team.

To create a coupon, you first need to create a discount, as in the section above. Then, you can set up your coupon in your catalog, apply your desired discount, and select your control settings. For example, you might choose to offer a coupon that’s only applicable for the next three months on a specific product.

Whereas discounts can only be applied to one subscription at a time, coupons enable your business to offer a discount consistently and repeatedly across multiple customers.

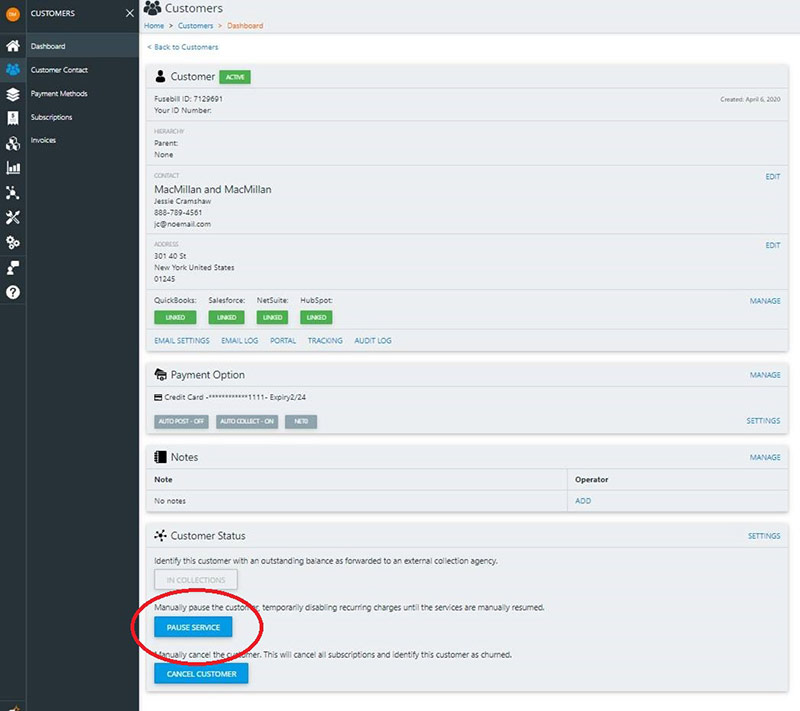

3. Place customers billed on a recurring basis on hold

Business slows or even comes to a full stop for many companies dealing with unprecedented times of crisis. And this may mean they have a significantly reduced—or even non-existent—inflow of revenue. As a result, subscription services may drop on the priority list for some of your own users as they slash budgets and restructure to weather the storm.

Rather than have struggling customers churn out entirely, consider placing their billing on hold.

Holding a customer essentially means clicking the “pause” button on their subscriptions. When you activate a hold, the recurring billing system is blocked from continuing the billing cycles until the subscriptions leave that state. This means no additional invoices will be generated and no billing periods will advance.

Your business can “unpause” the subscriptions and resume billing whenever it chooses.

When you take subscriptions off hold, you’ll be prompted to select one of the following options.

- Charge for all missed periods

- Charge for current period (Prorate if applicable)

- Charge for current period (Do not prorate)

- Do not charge for any missed periods

Selecting ‘Charge for all missed periods’ resumes billing from where it left off. It also generates an invoice once every hour for each billing period until it catches up to the most recent or appropriate billing period.

‘Charge for a current period (Prorate if applicable)’ generates an invoice for the remaining time in the current period. If charges are set to prorate, they will be prorated. Proration settings cannot be changed. The (Do not prorate) option prevents proration even if the charges are set to prorate.

And ‘Do not charge for any missed periods’ skips all the billing periods that would have taken place while on hold and will only bill on the next appropriate billing date.

If holding billing is a solution that might work for your business, work hand-in-hand with customers to decide on a timeframe that works for everyone.

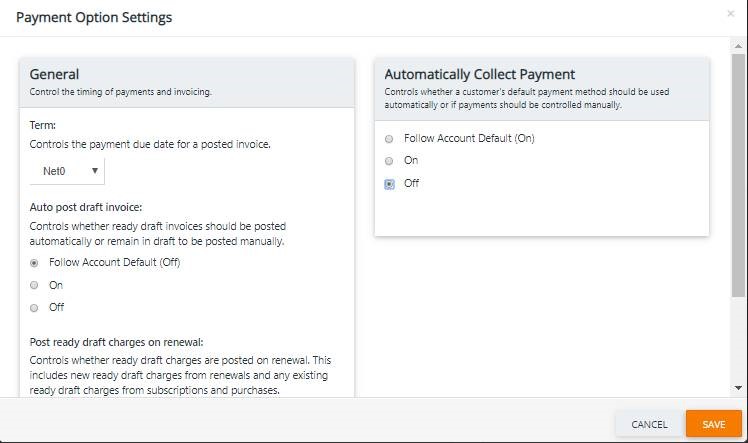

4. Turning off your automatic collection

At different times during your relationship with your customers, there may be special cases where you want to hold off on collecting automatic payments.

To clarify, ‘collection’ in your recurring billing system is the act of getting money from your customers’ credit cards or other payment methods.

Turning off automatic collection means your team will need to collect payment from a customer or all customers, rather than allowing the system to take care of this automatically.

As a result, your business will be able to collect payment from customers in a more ad hoc way, as and when you feel it’s appropriate.

Be wary that if a customer’s invoices are posting and they’re becoming overdue, the customer will be put into poor standing until a payment is received and recorded in your billing system.

5. Generate ready charges instead of performing automatic billing

Typically, your recurring billing system generates customer invoices and automatically posts and collects on them. This process can be set and adjusted at the account level under billing settings—or overridden on a per customer basis.

If you choose to disable automatic billing on a customer’s account, as mentioned, a member of your team will need to intervene before posting each invoice to that customer’s account. This can allow for changes to what the customer is invoiced for.

Once invoices are adjusted as desired, your team will need to collect payment from a customer or all customers, rather than allowing the system to do this automatically.

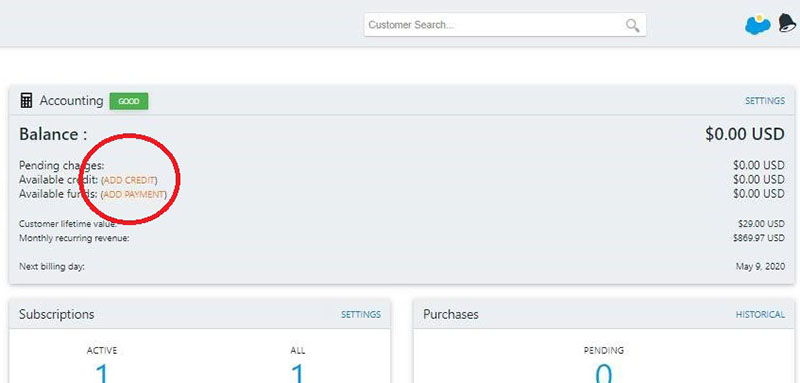

6. Award credits to your subscription customers

Awarding credits to your customers can be a simple approach to reducing the amount owing on their invoices. Credits are one-off expenses.

By awarding a credit, your business is essentially saying “ok, given the circumstances, we’re going to maintain your subscription, your invoice still needs to be paid, but we’re going to cover a certain amount of it.”

The credit is the amount your business decides to cover for your customer or customers’ invoices.

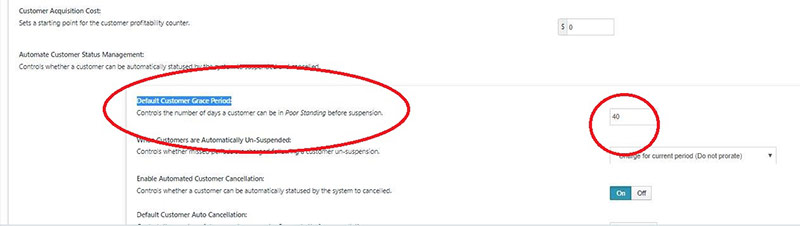

7. Apply account- and customer-level grace periods

An approach that might be a little more friendly to your own revenue stream is simply extending your customers a payment grace period—either at an account or customer level. This can provide that little bit of extra time they need to make their regular payment in full.

A grace period is the number of default days a customer can be in poor standing until their account is suspended.

There’s an account-level setting default in your Stax Bill recurring billing system under settings, billing periods.

The grace period can also be overridden at the customer level in case a specific customer is repeatedly in poor standing for longer than most but your business is okay with that.

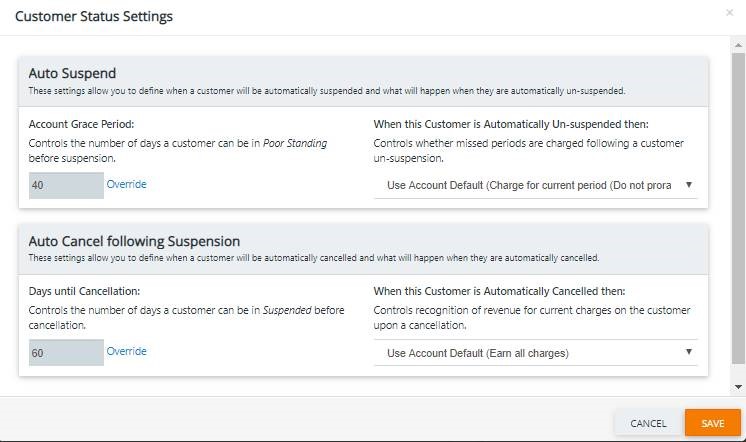

8. Extend payment extensions to your customers

What happens if you’ve decided to offer a grace period to customers struggling to pay on time and they still aren’t able to pay at the end of the grace period? You always have the option to extend the grace period.

If a customer has been in poor standing long enough, and their grace period is up, your billing system will start counting down their extension. When their extension is up, the customer will move into a suspended state.

A suspended state is the automated state when a customer is in poor standing, or behind on their invoice payments. The length of this is defined by the billing settings in your account and the extension that has been applied on the customer.

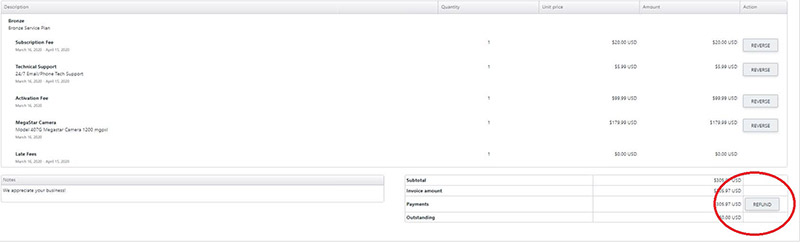

9. Administer payment reversals and refunds

If the above options simply won’t suffice, you might even decide to reverse a customer’s payment or provide a refund.

Reversal of charges—which are line items on your customers’ invoices—involves undoing the charge you applied to a customer and not providing the associated service. Reversals affect invoices that have been posted to your customer’s account.

While reversing charges could provide some much-appreciated relief to a customer that’s seriously tight on cash, this may be your least desirable option because reversals directly affect your business’s revenue.

A refund—which is technically the opposite of collections—involves sending the payment you already collected from your customer back to them. If the time period is short enough, you could void the collection instead.

With your recurring billing system, you need to account for any outstanding debts that result from refunding a customer. This means either providing credits to cover the expense for them—indicating they’re still getting the services agreed upon—or reversing the charges—indicating services will not be provided.

Flexibility can pay back

During times of crisis, a little leniency—if you’re able to grant it—can go a long way toward helping your customers stay on their feet. And aside from being the kind thing to do, building synergetic relationships with your customers is just good business.

A flexible approach to managing struggling customers can also enable your business to retain its user base, which can help you to recover as well when things begin to stabilize.

Need help actioning some of the features above for your recurring billing customers? The Stax Bill customer support team is always ready and happy to help.