In an ideal world, the subscription customer experience is seamless. A user selects desired products or services and transitions to payment with ease, followed quickly by a confirmation of the transaction. Recurring billing payments are then automatically charged or paid via an invoicing process.

When that experience takes an unexpected turn, 1 in 7 customers ultimately don’t make the purchase, resulting in $40 billion in lost revenue annually. What’s worse, 31% of them blame the merchant. This degrades customer loyalty and taints the company’s reputation.

What can businesses do to plug this revenue leak? The answer is multifaceted. Ultimately, you want to recover revenue while maintaining customer trust, and that takes finesse.

Getting transactions back on track means everybody wins: your business receives payment, and your customer receives their order. Let’s take a look at how to maximize this outcome.

Set up for success in revenue recovery

As with most business practices, getting in front of a problem before it exists is the best way to ensure success. Here are a few options to consider:

1. Flag recurring payments.

If your payment gateway allows it, be sure to flag recurring charges as such to avoid the gateway confusing them for fraudulent charges. This is a simple step that should be implemented if available.

2. Use automatic card updaters.

Credit card updaters provide the best of both worlds when it comes to expiring cards. They ensure that your business receives payment, and enhance the customer experience of updating their information (hint: they don’t have to!). If you aren’t already using a card updater, you are missing a huge opportunity to prevent revenue lost to missed payments.

Customers may or may not notice the automatic update, but they will notice if they have to take the time to input their new information.

3. Consider special cases.

Card updaters can fall short in some scenarios, such as with international, unsupported, or pre-paid/gift cards. Automated emails or in-app notifications tailored to users of international or unsupported cards can help alleviate interruptions within the customer experience. As for pre-paid and gift cards: beware—they need to be recharged to keep working, and are at high-risk for fraud.

4. Optimize payment update pages.

How user-friendly is your payment update page? Do your users know how to get to it? Customers are much more likely to update payment information quickly if a page can be accessed on mobile devices and if it bypasses a login screen. You can also enable instant verification to keep users on the page until their new payment method is verified.

If you aren’t using automatic updaters, be sure users receive notifications and links to update their information.

5. Make communication customer-centered.

Whether or not you use a card updater, communication should be tailored to the customer. Without a card updater, pre-dunning tactics are necessary. Send emails at a time of day when customer response is high, or use less aggressive in-app notifications if appropriate. These tactics can be most easily applied with a recurring billing platform, where features like this are built-in and customized to your business and customers.

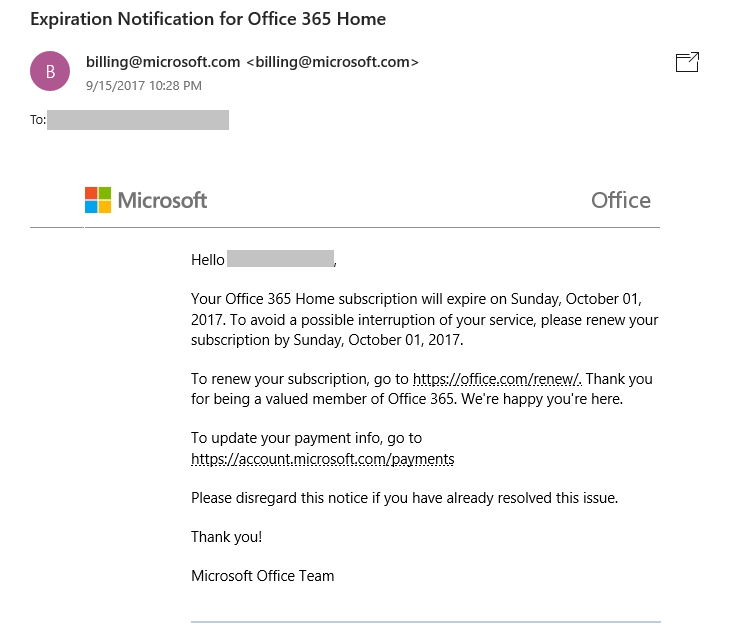

Expiring subscriptions, of course, require thoughtful communication as well. This email from Microsoft regarding an expiring Office 365 subscription is a great example:

Note the friendly, informative language, clear description of the service, date of expiration, and date by which action is necessary. A link for renewal is provided, as well as a link to update payment. This is clearly an automated email, so just in case, a closing statement to excuse the notice if it doesn’t apply is a nice touch for the few who may receive the notice in error.

The email is clear, concise, and considerate: a great example of effective customer communication.

6. Have backup payment gateways or methods.

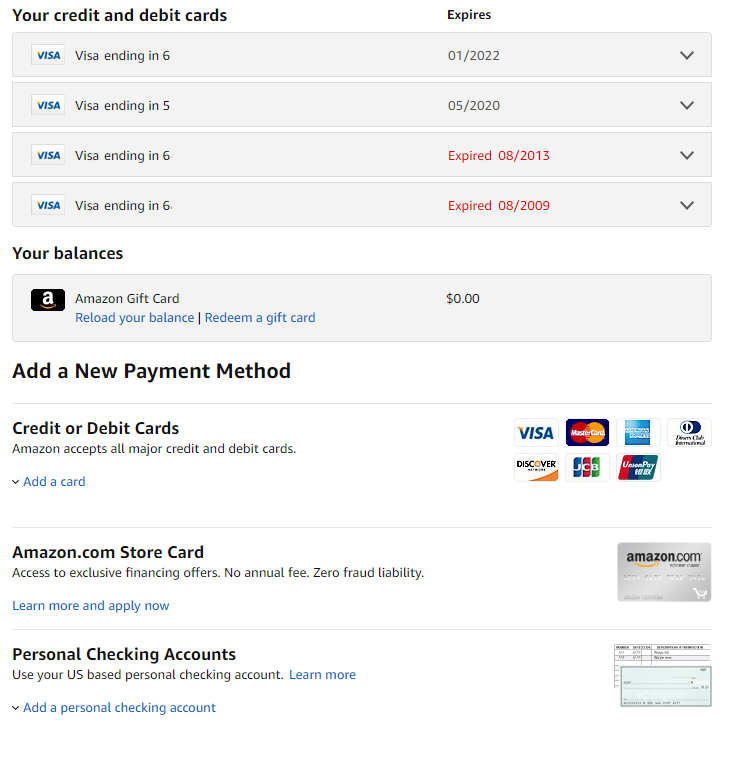

Consider employing a backup payment gateway, in case something goes wrong on your business’s side of a transaction (your payment processor’s API temporarily goes down, for example), or allow/encourage customers to select an alternate payment method when one fails. Amazon provides a great example of this, with the capability to store multiple cards and select many different forms of payment:

It’s worth noting that debit cards (ACH/SEPA) have a very low rate of payment failure because they are directly tied to a customer’s bank account. It may be difficult to encourage customers to use debit instead of credit, and processing payments do take a little more time.

However, making the option available can reduce declined transactions and be worth it in the long run. A complete subscription management and recurring billing platform can automate the payment process and support multiple payment gateways, ensuring a high rate of hassle-free transactions.

7. Check your MCC.

Your Merchant Category Code identifies your business and the category it belongs to for banks. There are certain transaction limits for some categories of businesses, and issuing banks can reject payments if your business’s bank description doesn’t match your MCC’s description.

Plug that revenue leak. If at first, you don’t succeed…

…retry, retry again. Credit cards are declined for a variety of reasons, and those reasons are categorized as either soft or hard declines.

- Soft Declines. As a general rule, it’s safe to retry a card that has received a soft decline immediately, as soft declines are temporary. However, do not retry a card more than 4 times in 16 days, or you risk raising an e-commerce indicator (ECI) flag.

- Hard Declines. Hard declines can’t be resolved quickly, so they do not warrant retries. Whether a card has received a hard decline or recurring soft declines, an active user would benefit in this situation from the option to select an alternate payment.

Alternate payment methods aside, retrying credit cards is in itself a balancing act. Keeping in mind that up to 70% of merchant-declined transactions are legitimate transactions, it is important to remember that a decline is likely not the customer’s fault when designing an approach.

A great first step to maintaining a positive customer experience is separating card retries and email communication.

Most customers don’t need to know every time their payment fails and is retried. Employ information about customer usage and activity to determine when communication is required; a first-time payment failure for a usually reliable customer probably doesn’t warrant an email.

When reaching out to a customer about payment is necessary, continue to use relevant information to shape communication. Different customer profiles can be created to develop the contents and tone of an email, links provided, calls to action, etc. The more personalized and clear the communication is, the more likely you are to reduce confusion and increase a sense of appreciation.

As suggested previously, retries should happen promptly when a user has manually updated their card after a failed payment. A complete subscription billing platform allows you to automate and optimize the dunning management process. If your process enables receipt of payment the moment a user presents a valid method, you’ve successfully streamlined the experience for everyone.

When retries run out

When all efforts have been made to gather updated payment information, there comes a time when retrying no longer makes sense. This point is considered the end of the “dunning management cycle”. It can be tempting to simply cancel a subscription here, but there are other, better options worth considering if you are still hoping to recover revenue at this stage.

A subscription pause (or temporary deactivation/hold) is likely to be a better option than cancelling.

There are many benefits to this. For one, if the customer is still an active user of the service, they will notice when they lose access, prompting them to update their payment method, re-subscribe, or perform any other actions necessary to restart the service. This approach keeps a user’s information as a subscriber and creates a much better experience for everyone.

Unlike cancelling, pausing a subscription reduces the need to re-create or reinstate an account, and can be very easily done with a subscription management platform.

In addition to pausing the account, maximize your odds of revenue recovery by keeping the invoice open and unpaid. If the customer returns to reactivate their account, their balance due will be in the system waiting. This ensures you get your payment before they continue using the service.

Avoiding and handling revenue leaking chargebacks

Chargebacks are another revenue-eater for businesses. Chargebacks occur when a customer disputes a charge on their credit card, and this can happen for many reasons. At worse, chargebacks mean returned payments. At best, they require effort and energy to fight. Merchants rarely win disputed chargebacks. There are a number of things a business can do to prevent chargebacks from happening:

1. Deny expired and invalid cards.

Be sure to set up your system to reject invalid or expired cards before the transaction is complete. An accepted but invalid card can cause a chargeback even without customer intervention.

2. Have your branding clear on statements.

Most customer chargebacks happen when users don’t recognize a company name on their statement. You can inform first-time customers what to expect to see on their statement when they make a purchase with you, or you can take a page from 37 Signals, who reduced chargebacks by 30% by changing their company name/DBA in their billing statement to a URL that explains their products and invoicing. You can also appear as a business number on statements, so customers can call to inquire about charges.

3. Fight fraud.

Fraud is the most common cause of chargebacks, and a business’s responsibility to ensure that purchases are not being made with stolen credit cards. Sign up for fraud tracking mechanisms and put together tougher verification steps for purchases originating in countries which are considered high-risk for credit card fraud.

4. Minimize phone orders and manual processing.

Customers may try to deny a phone purchase, and this can be very difficult to fight. Avoid accepting orders over the phone. If your business does, be sure to get as much information as possible, including the billing address and CVV number. Even then, however, human error can become an issue. Use automation to reduce mistakes made during ordering.

5. Ship/provide quality goods and services.

This should be obvious, but it’s worth noting. Many chargebacks are initiated by unsatisfied customers who either didn’t receive what they paid for, or found it to be in poor condition or substandard. Needless to say, it is important to provide value and clearly describe what customers can expect from your business, as well as having a clear refund policy that dissatisfied customers can access.

While these are great preventative measures, nothing is foolproof, and chargebacks will inevitably happen. If customers are potentially abusing chargebacks, it is possible to fight them. You’ll need to have collected evidence about the transaction and be able to easily compile it for a dispute response package. Some chargebacks are indisputable, and they do expire, so be ready to act quickly and prioritize which chargebacks to fight.

Automation can accelerate revenue recovery

There’s a lot to digest in the realm of revenue recovery, but the good news is that much of it can be automated. What’s best for your business will depend on many factors, and can change over time. Just imagine how much it would shake things up to change billing from weekly to monthly, or monthly to annual, as Spotify did for a limited time in 2017.

With the right subscription management and recurring billing fintech solution at your side, however, even big changes are simplified through automation.

Check out this link to find out if your business is ready for billing automation.