We’ve all experienced it: you purchase a product, start using it, and find out too late that there was a better deal available. Perhaps the same product was on sale elsewhere, or more research would have uncovered a better version at a comparable price.

Cue the buyer’s remorse.

For many business models, strict return policies or contracts lock in the sale. Customers in this situation have limited options after the product has been used, and the business ultimately retains the revenue. For recurring billing businesses, however, buyer’s remorse typically translates into churn.

Buyer’s remorse in subscription business models isn’t limited to competitive comparison. Products and services that don’t meet expectations, a lack of engagement, and confusing or unfriendly billing strategies can all lead customers down the path to churn.

So how can your business prevent buyer’s remorse to reduce its customer churn rate? Here are four steps to keeping both customer satisfaction and retention high.

1. Get The Right Customers, and Onboard Them Well

The road to churn prevention begins with targeting good-fit leads. Good-fit leads are those that have the greatest chance of becoming customers and finding your product or service useful.

Most retirees, for example, don’t need job search apps. As a result, targeting and acquiring them will likely result in churn. Continually strive for better-fit leads when possible.

Additionally, make sure your marketing and sales materials are clear about what your product can and cannot do, and provide realistic timelines. No one wants to be charged for features they don’t need or be forced into a longer contract than they’re comfortable with. Anything that makes a customer feel manipulated can result in churn.

Once you’ve acquired a good-fit customer, it’s a race to prove your value. Customers are looking for outcomes. Fail to provide a direct path from activation to desired outcome, and your customers will cancel post-haste.

To provide that path and prevent churn, you’ll need great onboarding. Optimized onboarding highlights key functions and features, nails communication, celebrates successes and provides training and assistance when needed.

G Suite does a great job of helping new users track their progress and find help with a toolbar like the one above.

As for communication, intelligent subscription billing software can generate automated welcome emails upon sign up and activation, and at other pivotal points during the customer journey, such as payment. The right billing software can also prevent involuntary churn brought on by failed payments with automated dunning management: a win-win!

New customers should quickly feel welcome, gain a sense of control, and see a path to success. The faster, the better.

2. Engage Customers to Keep Them Invested

With monthly recurring revenue (MRR) all but guaranteed in the subscription business model, it can be tempting to sit back and watch the dollars roll in. This is a mistake.

Customers grow, and their needs and demands evolve. They expect your product or service to do so with them. Otherwise, why would they keep paying month after month, or year after year?

To keep customers invested, you’ll need to touch base with them occasionally to remind them why they chose you, and to thank them for doing so. Highlight your most popular features, as well as anything new, like Wyzowl did with this email.

Wyzowl also included a special offer to those buying a testimonial video within a month, doubling down on its churn prevention tactics.

Special offers can be tricky to manage, of course, but robust recurring billing platforms make it easy. They enable businesses to perform catalog updates for new features and also handle promotional pricing offers that automatically become unavailable after a special offer’s end date. Consider similarly rewarding your long-term customers with anniversary specials or upgrades, and watch your retention rise.

Acquiring feedback is another useful tactic for keeping your customers from churning—so long as you actually act on it.

Ask customers what they love about your product or service, as well as what they don’t. If they’re struggling to reach goals, find out why and what they need. The hardest feedback is often the best feedback.

And as we’ve noted before, it can be better to have unhappy subscription customers than quiet ones.

3. Hone in On Inactivity

As Allan Wille, co-founder of Klipfolio, points out, “consumers may get annoyed if they end up regularly paying for a service they don’t use.”

This, of course, leads to churn.

Even good-fit customers can fall into a slump with a product. As such, you need to watch for inactivity. A dip in use is a major red flag and should trigger some sort of response from your team.

Reach out to inactive customers and ask whether the product is still meeting their needs. Alternately, offer an incentive to come back, like UberEats did with this email.

If you’re lucky, a customer may simply need an upgrade, add-on, or additional feature to get back on track. In this case, congratulations! You’ve just unlocked an opportunity to tap into expansion MRR, which greatly minimizes the impact of churn.

Of course, you can’t offer these types of upsells or cross-sells if you haven’t been growing and evolving your business in line with the needs of your customers. Again, it’s important to continually improve your product or service and keep customers updated to maintain engagement and retention.

4. Consider Your Billing Model

Customers are less likely to experience buyer’s remorse if they feel they got a good deal. Your billing model can drastically shape that perception.

For example, a model that enables a user to pay less per month as long as they pay upfront or opt into an annual contract can feel like a good deal to a customer who plans to stick around long-term.

However, for businesses tapping into an intermittent market, usage-based billing may be more appropriate. Other recurring billing businesses may need a combination of approaches, or a hybrid billing model.

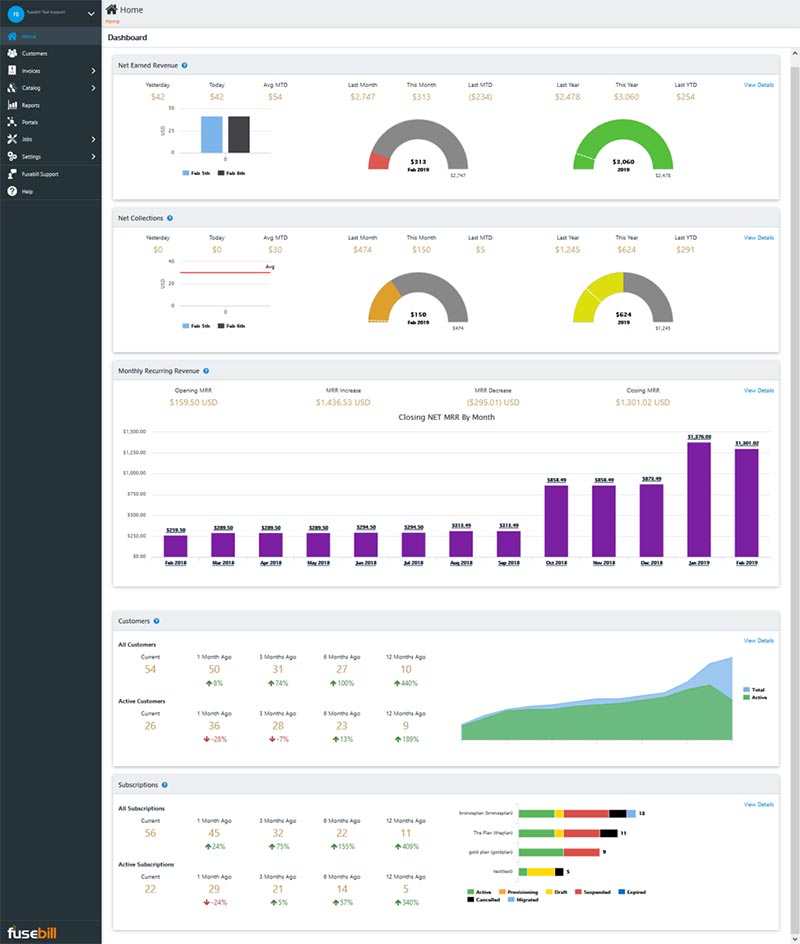

Agile subscription billing software such as Stax Bill can help businesses experiment with the right billing models which are optimized for retention. It even provides easy-to-read dashboards that track your business’s financial health.

Preventing both voluntary and involuntary churn is essential. Churn prevention tactics are centered around customer satisfaction. And satisfied customers stick around, upgrade, and even recommend businesses.

An intelligent billing platform streamlines invoicing and payments, as well as the user experience. And you can leverage it with other business software like Salesforce, NetSuite, or HubSpot to relieve operational chokepoints and increase customer retention.

With the right product, approach, and tools, any recurring billing business can combat buyer’s remorse and involuntary churn, lowering its churn rate and fueling growth.